Introduction to DeFi and Staking

Welcome to the dynamic world of DeFi Staking, a revolutionary approach in decentralized finance that’s reshaping how we think about earning from cryptocurrency investments. In this comprehensive blog post, we’ll navigate through the intricacies of DeFi Staking, exploring its mechanics, opportunities, and the challenges it presents. Whether you’re a seasoned investor or new to the crypto realm, this guide is designed to provide you with a thorough understanding of DeFi Staking, its impact on the cryptocurrency market, and how to engage with it securely and effectively. Join us as we delve into this exciting and ever-evolving landscape.

Table of Contents

Understanding DeFi Staking

Decentralized Finance, or DeFi, has revolutionized the way we view financial transactions and investments, particularly within the blockchain space. Central to this revolution is the concept of DeFi Staking, a process that is not only pivotal to maintaining the ecosystem but also offers a unique investment opportunity. In this section, we’ll delve into the fundamentals of DeFi Staking, aiming to provide a clear and comprehensive understanding.

What is DeFi Staking?

At its core, DeFi Staking refers to the act of locking up cryptocurrencies in a DeFi protocol to earn rewards or interest. It’s akin to earning interest in a traditional bank savings account, but with DeFi, the process is entirely on blockchain networks. Staking is critical in networks that use a Proof of Stake (PoS) consensus mechanism, where it directly contributes to the security and functionality of the blockchain.

How Does DeFi Staking Work?

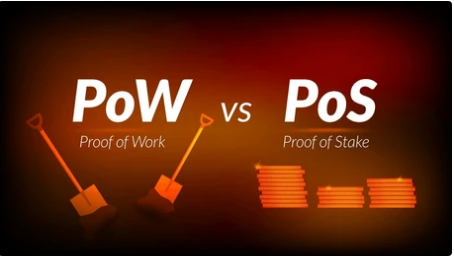

In PoS-based blockchains, validators are responsible for processing transactions and creating new blocks. Unlike Proof of Work (PoW) systems that require computational power, PoS networks select validators based on the number of tokens they hold and have staked. When you participate in DeFi Staking, you are essentially locking your tokens into a smart contract. These tokens then act as your stake in the network, indicating your commitment and investment in the network’s health.

The Rewards of DeFi Staking

The primary allure of DeFi Staking is the potential for earning rewards. These rewards are often in the form of additional cryptocurrency. The reward rate can depend on the network’s rules, the amount staked, and the total number of staking participants. It’s a way to earn passive income on your cryptocurrency holdings, as opposed to just holding your tokens in a wallet.

Risks Involved

As with any investment, DeFi Staking comes with its risks. The value of your staked tokens can fluctuate due to market volatility. There’s also the risk of “slashing,” where a portion of your staked tokens can be lost if the validator node you’re staked on violates network rules. Additionally, there are risks associated with smart contract vulnerabilities.

Where to Stake

Numerous DeFi platforms offer staking services, each with its unique features and reward mechanisms. It’s crucial to research and choose a platform that aligns with your investment strategy and risk tolerance.

The Role of DeFi Staking in Blockchain Networks

DeFi Staking plays a transformative role in the world of blockchain and cryptocurrency. It’s not just a method for earning passive income; it’s integral to the functioning and security of many blockchain networks. Let’s explore how DeFi Staking impacts and benefits these networks.

Staking in Proof of Stake (PoS) Networks

In blockchain networks that utilize a Proof of Stake (PoS) model, DeFi Staking is essential. Unlike the Proof of Work (PoW) model, which requires immense computational power to validate transactions and create new blocks, PoS relies on staked tokens. Here, users who stake their cryptocurrency act as validators, participating directly in the maintenance and operation of the blockchain.

Enhancing Network Security

One of the critical roles of DeFi Staking is bolstering network security. In PoS networks, the more tokens staked, the more secure the network is. This is because a higher stake means a higher cost for any potential malicious attack. Validators are disincentivized from acting dishonestly as they have their own stakes at risk.

Governance and Voting

In many DeFi platforms, staking also involves governance. Token holders who stake often get voting rights. These rights allow them to participate in key decisions about the network’s future, such as upgrades or policy changes. This democratic approach ensures that the network evolves in a way that benefits the majority of its stakeholders.

Network Efficiency

Staking contributes to the efficiency of blockchain networks. It enables faster transaction processing times and reduces the energy consumption compared to PoW systems. This increased efficiency is crucial for scalability and broader adoption of blockchain technology.

DeFi Staking is more than just an investment strategy; it’s a foundational component of modern PoS blockchain networks. By participating in staking, users support the network’s security, efficiency, and democratic governance, all while potentially earning rewards.

Popular Platforms for DeFi Staking

The landscape of DeFi staking is rich and varied, with numerous platforms offering unique opportunities and features. In this section, we’ll explore some of the most popular platforms for DeFi Staking, highlighting what makes each stand out. This will help you make informed decisions when choosing where to stake your cryptocurrency.

Ethereum 2.0

Ethereum, transitioning to Ethereum 2.0, is perhaps the most notable platform for DeFi Staking, thanks to its shift from Proof of Work (PoW) to Proof of Stake (PoS). Ethereum 2.0 aims to enhance scalability and reduce energy consumption. Stakers in Ethereum 2.0 can earn rewards by contributing to the network’s security and efficiency.

Binance Smart Chain

Binance Smart Chain (BSC) is known for its low transaction fees and high performance. It offers a variety of staking options through Binance Staking, catering to both beginner and experienced stakers. The platform is praised for its user-friendly interface and a wide range of supported assets.

Polkadot

Polkadot stands out with its unique “shared security” model, where multiple blockchains can connect and secure themselves under one umbrella. Staking on Polkadot not only helps secure the main network but also the various interconnected parachains, providing a more diverse staking experience.

Cardano

Cardano has gained attention for its research-driven approach and strong focus on sustainability. Its staking model is designed to be more accessible, allowing even small token holders to participate and earn rewards. Cardano’s emphasis on decentralization and community involvement makes it a popular choice for many.

Tezos

Tezos is another prominent platform that utilizes DeFi Staking. It is known for its on-chain governance and ability to evolve by upgrading itself. Staking on Tezos, also known as “baking,” allows participants to contribute to the network’s stability and efficiency.

Cosmos

Cosmos offers an “Internet of Blockchains” model. It allows different networks to communicate and transact with each other. Staking in Cosmos involves securing the hub and the various interconnected chains, making it an intriguing option for those interested in inter-blockchain connectivity.

These platforms are just the tip of an iceberg in the world of DeFi Staking. Each has its unique attributes and community, catering to different preferences and investment strategies. When selecting a platform for staking, consider factors like security, user experience, reward rates, and the platform’s overall vision and stability.

How to Get Started with DeFi Staking

Embarking on your journey in DeFi Staking can be both exciting and rewarding. This guide is designed to help beginners understand the basic steps involved in getting started with DeFi Staking. The process, while straightforward, requires careful consideration to ensure a smooth and secure experience.

Step 1: Understand the Basics

Before diving into DeFi Staking, it’s essential to have a clear understanding of what it involves. This includes knowing about blockchain technology, Proof of Stake (PoS) mechanisms, and how staking contributes to a blockchain network. Familiarize yourself with the terms and concepts used in the DeFi space.

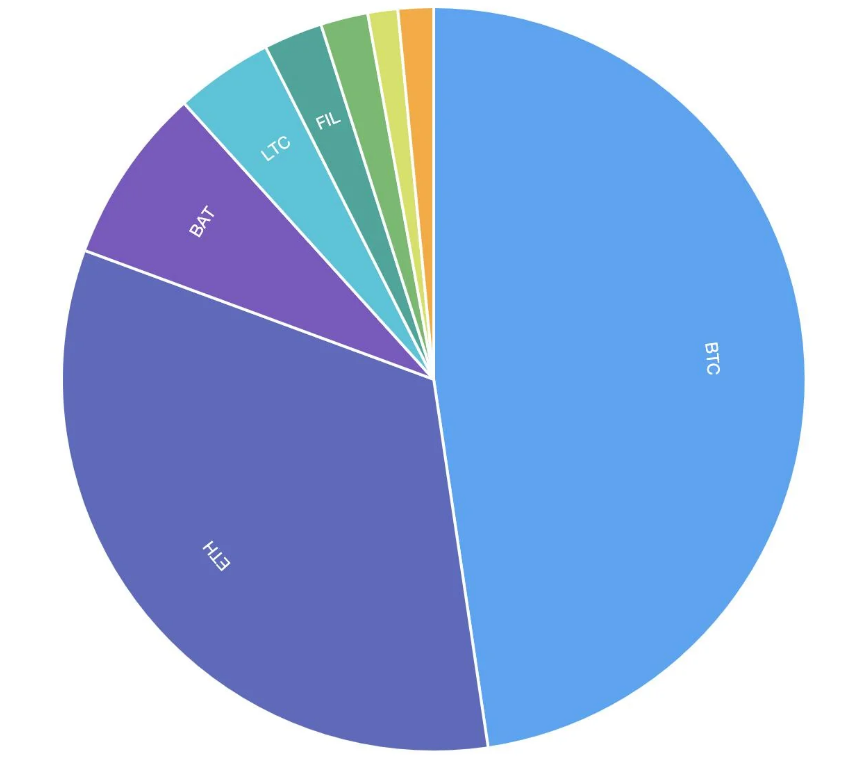

Step 2: Choose a Cryptocurrency

The first practical step is selecting a cryptocurrency for staking. Look for coins that operate on a PoS blockchain. Consider factors like the coin’s market performance, staking rewards, and the overall stability of the blockchain.

Step 3: Select a Staking Platform

With numerous DeFi Staking platforms available, choosing one that aligns with your needs is crucial. Research platforms like Ethereum 2.0, Binance Smart Chain, or Cardano. Evaluate their security features, user interface, reward systems, and community feedback.

Step 4: Set Up a Digital Wallet

To participate in DeFi Staking, you’ll need a digital wallet that supports staking. This wallet will store your cryptocurrencies safely. Ensure that the wallet is compatible with the cryptocurrency you’ve chosen and the staking platform.

Step 5: Transfer Cryptocurrency to Your Wallet

Once your wallet is set up, transfer the cryptocurrency you intend to stake into it. This usually involves purchasing the cryptocurrency through an exchange and then transferring it to your wallet.

Step 6: Start Staking

Navigate to the staking section of your chosen platform and follow the instructions to stake your cryptocurrency. This typically involves locking up your coins for a set period. Be sure to understand the terms and conditions, including the lock-up period and any penalties for early withdrawal.

Step 7: Monitor Your Staking

Regularly monitor your staking activity. Keep an eye on the performance of your staked assets and any changes in the reward rates or staking policies of the platform.

Getting started with DeFi Staking is a process that requires careful planning and consideration. By following these steps, you can embark on your staking journey with a solid foundation and a better understanding of how to maximize your participation in DeFi Staking.

Rewards and Earnings in DeFi Staking

One of the most appealing aspects of DeFi Staking is the potential to earn rewards and generate income. Understanding how these rewards are calculated and what factors influence your earnings is key to making the most out of your staking investments.

How are Rewards Calculated in DeFi Staking?

The calculation of staking rewards in DeFi can vary significantly from one platform to another. Generally, rewards are based on several factors:

- Amount Staked: The more tokens you stake, the higher your potential rewards.

- Network Inflation: Some networks increase the supply of tokens over time, which can be distributed as staking rewards.

- Total Number of Stakers: Rewards are often divided among all stakers, so the total number of participants can affect your individual return.

- Staking Time: Longer staking periods can sometimes lead to higher rewards, as it shows a commitment to the network.

Types of Rewards

Rewards in DeFi Staking can come in various forms:

- Additional Tokens: The most common form of reward is receiving additional tokens.

- Transaction Fees: On some platforms, stakers earn a portion of the transaction fees.

- Other Incentives: Certain platforms may offer additional incentives like governance rights or access to exclusive features.

Factors Affecting Earnings

Several factors can influence your earnings in DeFi Staking:

- Market Volatility: The value of your staked tokens and rewards can fluctuate with the market.

- Platform Reliability: The security and stability of the platform can impact your earnings.

- Regulatory Changes: Changes in regulations can affect the operation of DeFi platforms and, subsequently, your rewards.

Risks and Considerations

While the potential for earning through DeFi Staking is significant, it’s important to be aware of the risks:

- Market Risk: The volatile nature of cryptocurrencies means the value of your staked assets and rewards can change rapidly.

- Liquidity Risk: Staked assets are locked up for a period, which might affect your liquidity needs.

- Platform Risk: Technical issues or security breaches on a staking platform can lead to loss of funds.

DeFi Staking offers a unique opportunity to earn rewards and grow your cryptocurrency holdings. By understanding how these rewards are calculated and what factors affect your earnings, you can make more informed decisions and optimize your staking strategy.

Risks and Challenges in DeFi Staking

While DeFi Staking presents numerous opportunities for earning rewards, it’s essential to recognize and understand the risks and challenges involved. Being informed about these aspects can help you navigate the DeFi Staking landscape more safely and effectively.

Market Volatility

The cryptocurrency market is known for its high volatility. The value of your staked assets can fluctuate widely in a short period. This volatility affects not only the underlying asset but also the potential rewards from staking.

Smart Contract Vulnerabilities

DeFi platforms operate on smart contracts which are coded agreements on the blockchain. If these contracts have bugs or vulnerabilities, it could lead to the loss of staked funds. Even well-audited contracts can sometimes be susceptible to unforeseen exploits.

Liquidity Risk

When you stake your tokens, they are locked up for a certain period. During this time, you cannot access or sell these assets to respond to market movements. This lock-up period might pose a liquidity risk, especially in a volatile market where quick access to your assets is crucial.

Impermanent Loss

In some DeFi Staking scenarios, particularly when providing liquidity to a pool, you might be exposed to impermanent loss. This occurs when the price of your staked assets changes compared to when you deposited them, potentially leading to losses if the price divergence is significant.

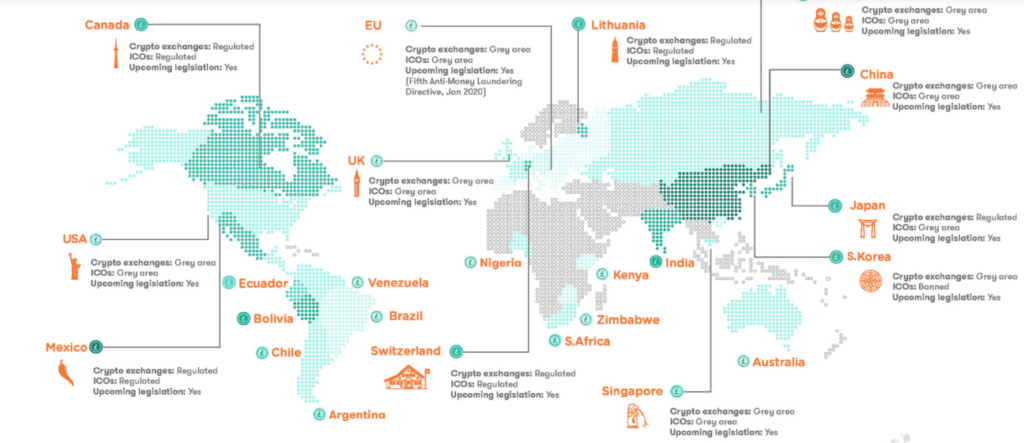

Regulatory Risk

The regulatory environment for cryptocurrencies and DeFi is still evolving. Changes in regulations can impact DeFi platforms and staking protocols, potentially affecting your investments. It’s crucial to stay informed about the legal landscape in your jurisdiction.

Platform Risk

The platform you choose for DeFi Staking might face operational issues, security breaches, or even regulatory challenges. These can all pose risks to your staked assets. Researching and choosing reputable platforms is essential.

Understanding the risks and challenges in DeFi Staking is crucial for anyone looking to enter this space. While the potential rewards are enticing, being aware of and mitigating these risks can lead to a more secure and rewarding staking experience.

Impact of DeFi Staking on the Cryptocurrency Market

DeFi Staking has not only revolutionized the way investors earn rewards but has also significantly impacted the broader cryptocurrency market. Understanding this impact is crucial for anyone involved in crypto investments.

Increasing Market Participation

DeFi Staking has lowered the entry barrier for crypto investors. By allowing individuals to earn passive income through staking, it has attracted a broader audience to the cryptocurrency market. This increased participation contributes to market growth and stability.

Liquidity Provision

One of the critical roles of DeFi Staking is providing liquidity to the market. When users stake their crypto assets, they often contribute to liquidity pools, which are essential for facilitating trading and other financial activities on DeFi platforms. This liquidity is vital for the efficient functioning of the market.

Price Stabilization

By locking up assets in staking protocols, DeFi Staking can reduce the circulating supply of certain cryptocurrencies. This reduced supply can lead to a decrease in price volatility, thereby stabilizing prices, especially for tokens with significant amounts staked.

Influence on Token Economics

DeFi Staking directly influences the token economics of cryptocurrencies. Staking rewards often involve the distribution of new tokens, affecting the token’s supply dynamics. Understanding these economic impacts is essential for investors and market analysts.

Governance and Decentralization

DeFi Staking often involves governance mechanisms, where stakers get a say in the development and decision-making processes of the platform. This governance role enhances decentralization and community involvement in the market’s evolution.

The impact of DeFi Staking on the cryptocurrency market is multifaceted. It has not only provided new opportunities for earning and participation but has also played a significant role in shaping market dynamics, liquidity, and governance structures. As DeFi continues to evolve, its influence on the cryptocurrency market is expected to grow further.

Legal and Regulatory Aspects of DeFi Staking

Navigating the legal and regulatory landscape of DeFi Staking is crucial for anyone participating in this space. As a relatively new and rapidly evolving field, DeFi faces various regulatory challenges and considerations. Understanding these can help stakers and platforms operate within legal boundaries and adapt to future changes.

Current Regulatory Landscape

The regulatory environment for DeFi and staking is still in its formative stages. Different countries have varying approaches, ranging from strict regulations to more open frameworks. In many jurisdictions, the legal status of DeFi Staking remains a gray area, often leading to uncertainty among participants.

Compliance Challenges

One of the primary challenges in DeFi Staking is ensuring compliance with existing financial laws and regulations. This includes Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. DeFi platforms and users must be aware of these requirements and how they apply to staking activities.

Taxation of Staking Rewards

The taxation of rewards from DeFi Staking is a complex and evolving issue. In many regions, staking rewards are subject to income tax, similar to other forms of investment income. Understanding the tax implications in your jurisdiction is essential for compliance and financial planning.

Future Regulatory Developments

As DeFi continues to grow, it’s likely to attract more attention from regulators. Future regulatory developments could significantly impact how DeFi Staking operates, potentially bringing more clarity, compliance requirements, and consumer protections.

Role of Legal Advisors

For DeFi platforms and individual stakers, consulting with legal professionals who understand the cryptocurrency and DeFi landscape can be invaluable. Legal advice can help navigate the current regulations and prepare for future changes.

The legal and regulatory aspects of DeFi Staking are complex and dynamic. Staying informed and compliant with current regulations is vital for anyone involved in DeFi. As the regulatory landscape evolves, adapting to these changes will be crucial for the continued growth and legitimacy of DeFi Staking.

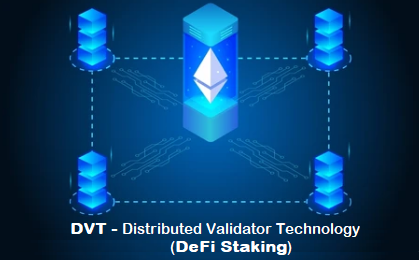

Technological Innovations in DeFi Staking

The DeFi staking landscape is continuously evolving, driven by a myriad of technological innovations. These advancements are not only enhancing the user experience but also increasing security, efficiency, and accessibility. Here’s an overview of the key technological trends shaping the future of DeFi Staking.

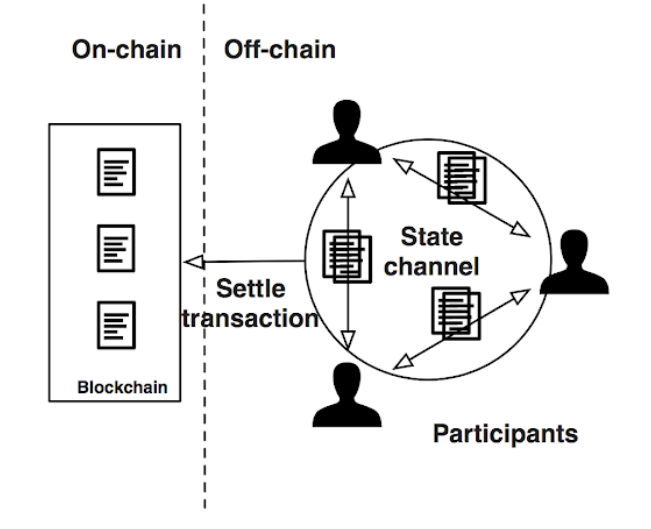

Layer 2 Scaling Solutions

As DeFi platforms grow, they face challenges related to scalability and high transaction fees. Layer 2 solutions, like rollups and sidechains, are being developed to address these issues, allowing for faster and cheaper transactions. This makes DeFi Staking more accessible and efficient.

Improved Smart Contract Design

Smart contracts are at the heart of DeFi Staking platforms. Innovations in smart contract design are enhancing their security, efficiency, and functionality. This includes upgradable contracts, modular designs, and formal verification methods to reduce the risk of bugs and exploits.

Cross-Chain Staking

Cross-chain technology allows for the interaction and interoperability between different blockchains. This innovation enables users to stake assets on one blockchain and use them across multiple chains, expanding the possibilities and potential rewards of DeFi Staking.

Decentralized Autonomous Organizations (DAOs)

DAOs are becoming an integral part of DeFi Staking platforms, providing a more democratic and transparent way to make decisions. Through DAOs, stakeholders can propose, vote on, and implement changes, leading to more community-driven and adaptable platforms.

Privacy Enhancements

Privacy is a growing concern in the DeFi space. Innovations like zero-knowledge proofs are being integrated into staking protocols to provide users with more privacy, allowing them to participate in DeFi Staking without exposing sensitive information.

Technological innovations are propelling DeFi Staking into a new era of efficiency, security, and user empowerment. As these technologies continue to mature and evolve, they promise to further revolutionize the DeFi landscape, making it more accessible, versatile, and robust.

Community and Governance in DeFi Staking

The community and governance aspects are vital components in the DeFi Staking ecosystem. They play a significant role in shaping the protocols and policies of DeFi platforms, ensuring that the interests of all stakeholders are represented and safeguarded.

The Role of the Community

In DeFi Staking, the community is not just a group of passive participants; they are active contributors to the platform’s growth and success. Community members share insights, participate in discussions, and help identify and resolve issues. This active engagement fosters a robust and supportive environment essential for the sustainability of DeFi platforms.

Governance Models in DeFi

DeFi platforms employ various governance models, but most are rooted in the principles of decentralization and democratic decision-making. The most common model is token-based governance, where decisions are made through voting, and the voting power is often proportional to the amount of tokens a user holds or stakes.

Importance of Decentralized Governance

Decentralized governance in DeFi Staking allows for a more egalitarian approach to decision-making. It reduces the risk of centralized control and aligns the platform’s development with the community’s interests. This governance structure also enhances transparency and accountability.

Challenges in Governance

While decentralized governance has many benefits, it also faces challenges such as voter apathy, where a small percentage of token holders participate in decisions, or the risk of large stakeholders (whales) having disproportionate influence.

The Evolution of Governance in DeFi

Governance models in DeFi Staking are continually evolving. Innovations like quadratic voting or delegated voting aim to address existing challenges and make the governance process more equitable and representative of the broader community’s interests.

Community and governance are the backbones of the DeFi Staking ecosystem. They ensure that the platform remains true to its decentralized ethos, adapting and evolving according to the collective will of its participants. As DeFi continues to grow, so too will the sophistication and effectiveness of its governance structures.

Case Studies: Success Stories in DeFi Staking

Exploring successful case studies in the realm of DeFi Staking offers valuable insights and lessons. These success stories not only highlight the potential of DeFi Staking but also serve as inspiration for strategies and best practices in the space.

Case Study 1: Ethereum 2.0’s Shift to Proof of Stake

Ethereum’s transition to Ethereum 2.0 marks one of the most significant success stories in DeFi Staking. This shift from Proof of Work (PoW) to Proof of Stake (PoS) aimed to enhance network efficiency and scalability. The staking model of Ethereum 2.0 has attracted significant participation, securing the network and demonstrating the potential of PoS in large-scale blockchain ecosystems.

Case Study 2: Yield Farming on Compound

Compound’s introduction of yield farming revolutionized the DeFi Staking landscape. By enabling users to earn COMP tokens as rewards for staking, Compound not only incentivized participation but also introduced a novel way of distributing governance power among its users, aligning incentives and driving platform growth.

Case Study 3: Binance Smart Chain’s Staking Model

Binance Smart Chain (BSC) offers a compelling case study with its unique approach to DeFi Staking. By focusing on high throughput and low transaction costs, BSC has attracted a wide range of users and developers, fostering a rich ecosystem of decentralized applications (dApps). BSC’s staking model stands as a testament to the importance of balancing technical efficiency with user incentives.

Case Study 4: Polkadot’s Interoperability Approach

Polkadot presents a unique case in DeFi Staking through its interoperability approach. By enabling different blockchains to connect and share information, Polkadot has created a diverse and synergistic environment. Its staking model not only secures the network but also incentivizes collaboration and innovation across various blockchain projects.

Case Study 5: Aave’s Risk Mitigation Strategies

Aave’s success in DeFi Staking is notable for its robust risk mitigation strategies. By implementing features like a decentralized liquidity protocol and various staking options, Aave has managed to attract substantial user engagement while maintaining platform security and stability.

These case studies demonstrate the diverse strategies and innovations that have led to success in DeFi Staking. From Ethereum 2.0’s large-scale network upgrade to innovative approaches in yield farming and interoperability, these success stories provide valuable lessons and insights into the evolving landscape of DeFi Staking.

Best Practices for Secure and Effective DeFi Staking

To maximize the benefits and minimize the risks associated with DeFi Staking, it’s crucial to adhere to certain best practices. These guidelines help ensure a secure and effective staking experience, allowing you to capitalize on the opportunities DeFi offers while safeguarding your investments.

Research Thoroughly

Before engaging in DeFi Staking, conduct thorough research on the available platforms. Understand the staking mechanism they use, the underlying blockchain technology, and the reputation of the project. A well-informed decision is your first line of defense against potential risks.

Understand the Risks

Be aware of the risks involved, including market volatility, platform security, and regulatory changes. Understanding these risks helps in making more informed decisions and in choosing the right strategies to mitigate them.

Use Secure Wallets

The security of your digital wallet is paramount. Use wallets that are reputable and offer robust security features like two-factor authentication and multi-signature support. Regularly update your wallet software to ensure it has the latest security enhancements.

Diversify Your Portfolio

Diversification is a key strategy in investment, and this holds true for DeFi Staking as well. Spreading your investments across various platforms and cryptocurrencies can reduce risk and provide more stable returns.

Stay Informed and Adaptable

The DeFi space is rapidly evolving, so staying informed about the latest trends, technologies, and regulatory changes is crucial. Being adaptable allows you to adjust your strategies in response to market changes and new opportunities.

Practice Good Cyber Hygiene

Good cyber hygiene practices, like using strong passwords, secure internet connections, and avoiding phishing scams, are essential in safeguarding your digital assets. Be cautious about sharing personal information and be wary of too-good-to-be-true offers. See Cyber Security Tips below:

Following these best practices in DeFi Staking can greatly enhance the security and effectiveness of your investment. By being well-informed, cautious, and strategic, you can navigate the DeFi staking landscape with greater confidence and success.

Conclusion and Future of DeFi Staking

As we conclude our exploration into DeFi Staking, it’s evident that this innovative financial practice stands at the forefront of a transformative era in decentralized finance. DeFi Staking has not only democratized the process of earning from crypto assets but has also played a pivotal role in securing and governing blockchain networks.

Reflecting on the Journey

Throughout this journey, we’ve delved into the essentials of DeFi Staking, from understanding its fundamentals to navigating its risks and rewards. We’ve examined the impact of technological innovations and the critical role of community and governance. The success stories in DeFi Staking have shown us the remarkable potential and growth of this field.

The Road Ahead

Looking forward, the future of DeFi Staking appears both promising and dynamic. As blockchain technology continues to evolve, we can expect to see more advanced and user-friendly staking solutions. The increasing focus on scalability, security, and cross-chain functionalities will likely open new avenues for staking applications and strategies.

Continued Challenges and Innovations

However, challenges remain, particularly in the realms of regulatory clarity and platform security. The DeFi space must continue to innovate while addressing these challenges to maintain trust and stability. The ongoing development of more sophisticated governance models and risk mitigation strategies will be crucial in this regard.

The Role of Community and Education

The role of the community and continuous education cannot be overstated. As DeFi Staking becomes more mainstream, fostering an informed and engaged community will be vital for the sustained health and growth of the ecosystem.

Final Thoughts

DeFi Staking represents a significant step towards a more inclusive and efficient financial system. By empowering individuals to participate directly in financial networks, it opens up new possibilities for investment and wealth generation. As we move forward, it’s clear that DeFi Staking will continue to be an integral part of the ever-evolving landscape of decentralized finance.

FAQs on DeFi Staking

- What is DeFi Staking? DeFi Staking involves locking up cryptocurrencies in a DeFi protocol to contribute to the network’s security and efficiency. In return, participants earn rewards, typically in the form of additional cryptocurrency tokens.

- How does DeFi Staking differ from traditional staking? While traditional staking often involves supporting a blockchain network’s security and operations, DeFi Staking takes place within the decentralized finance ecosystem. This means it often includes participation in governance and other DeFi-specific activities, like liquidity provision.

- What are the risks associated with DeFi Staking? Key risks include market volatility, which can affect the value of staked assets and rewards; liquidity risk, as staked assets are often locked for a period; and smart contract risks, where vulnerabilities in the contract code could lead to losses.

- Can I lose money in DeFi Staking? Yes, there is a risk of losing money in DeFi Staking due to factors like market volatility, impermanent loss in liquidity pools, or issues with the staking platform or protocol itself, such as smart contract bugs or hacking incidents.

- How do I choose a DeFi platform for staking? Consider factors such as the platform’s security record, user interface, supported assets, reward rates, and community reputation. It’s also important to research the platform’s governance model and how it handles regulatory compliance. Conducting thorough due diligence is essential before committing your assets to a staking platform.