Introduction to P2P in DeFi Exchanges

Peer-to-Peer (P2P) Trading in Decentralized Finance (DeFi) Exchanges are revolutionizing the way we think about financial transactions, offering a new world of opportunities for investors, traders, and everyday users alike. At the heart of this revolution lies the promise of a financial system that is more accessible, transparent, and equitable.

This blog post aims to demystify the complex world of P2P in DeFi exchanges, providing you with a comprehensive guide that covers everything from the basics and benefits to security measures and how to get started. Whether you’re a seasoned investor or new to the world of cryptocurrency, understanding P2P DeFi exchanges is key to navigating this innovative and rapidly evolving sector. Join us as we explore the transformation potential of DeFi and how it’s setting the stage for the future of finance.

Table of Contents

Evolution of DeFi Exchanges

The landscape of financial exchanges has undergone a remarkable transformation with the advent of Decentralized Finance (DeFi). This evolution marks a shift from traditional, centralized financial systems to a more open, accessible, and transparent ecosystem. Let’s delve into the journey of how DeFi exchanges have evolved, paying special attention to the pivotal role played by Peer-to-Peer (P2P) networks.

The Genesis of DeFi

DeFi’s inception can be traced back to the early development of blockchain technology and cryptocurrencies. Initially, blockchain was primarily associated with Bitcoin and other digital currencies. However, the potential for decentralized, trustless transactions quickly sparked interest in broader applications. This is where the concept of DeFi began to take shape – a system where financial products and services could operate without centralized institutions.

Emergence of Early DeFi Platforms

The early stages of DeFi were marked by the development of platforms that mimicked traditional financial services, such as lending and borrowing, but operated on blockchain networks. These platforms laid the groundwork for more complex financial interactions and introduced the concept of smart contracts – self-executing contracts with the terms of the agreement directly written into code.

Below is an image of early stages of DeFi:

The Integration of P2P in DeFi Exchanges

As DeFi platforms evolved, the integration of P2P mechanisms became a game-changer. P2P in DeFi exchanges allowed users to interact directly with each other, bypassing intermediaries typical in conventional financial systems. This peer-to-peer interaction not only reduced transaction costs but also enhanced transaction speed and privacy.

Advancements in DeFi Exchange Technologies

The growth of DeFi exchanges has been fueled by continuous technological advancements. Innovations such as liquidity pools, yield farming, and automated market makers (AMMs) have further decentralized the trading process, offering users more control and flexibility. These technologies have also addressed some of the liquidity challenges faced by early P2P platforms.

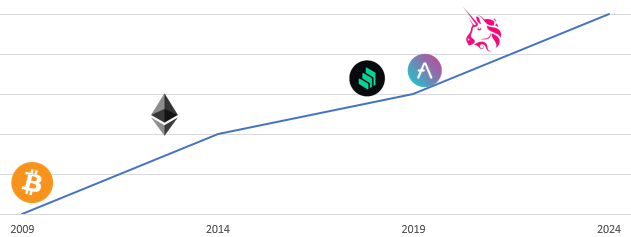

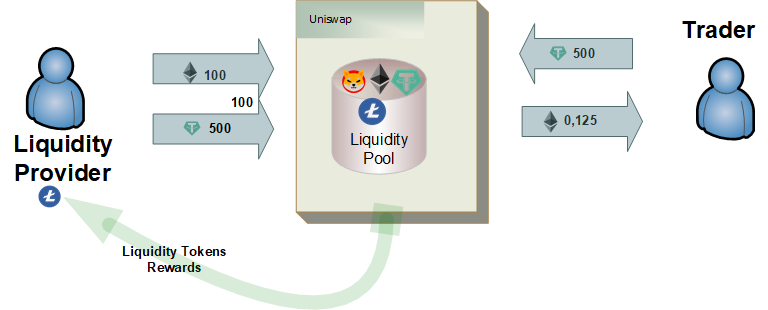

See below technologies like liquidity pools illustration:

The Current State and Challenges

Today, DeFi exchanges have become a cornerstone of the cryptocurrency market, offering a wide array of services from simple token swaps to complex financial instruments. However, this rapid growth has not been without challenges. Issues such as network congestion, high gas fees, and smart contract vulnerabilities have highlighted the need for ongoing development and regulation in the space.

The Future of P2P in DeFi Exchanges

Looking forward, the integration of P2P in DeFi exchanges is expected to continue shaping the landscape of decentralized finance. Innovations aimed at improving scalability, security, and user-friendliness are likely to drive further adoption. Moreover, with increasing regulatory clarity, DeFi exchanges could witness even broader mainstream acceptance.

Image below depicts potential future advancements in DeFi:

The evolution of DeFi exchanges, particularly the incorporation of P2P systems, marks a significant leap in the world of finance. This journey from rudimentary decentralized platforms to sophisticated financial ecosystems reflects the dynamic and innovative spirit of DeFi, paving the way for a more inclusive and efficient financial future.

Fundamentals of P2P in DeFi Exchanges

Understanding the fundamentals of Peer-to-Peer (P2P) mechanisms within Decentralized Finance (DeFi) exchanges is essential to grasp how these innovative platforms are reshaping the financial landscape. P2P in DeFi exchanges represents a pivotal shift from traditional, centralized financial systems to a more decentralized and democratized model. Let’s explore these fundamentals in a concise and clear manner.

The Core Concept of P2P in DeFi

At its heart, P2P in DeFi exchanges is about direct interaction between participants without the need for intermediaries. Unlike traditional finance where transactions often pass through banks or other financial institutions, P2P DeFi exchanges facilitate a direct pathway between users. This model harnesses blockchain technology to ensure transactions are secure, transparent, and immutable.

Decentralization and Blockchain

The backbone of P2P in DeFi exchanges is blockchain technology. This decentralized ledger records all transactions across a network of computers, making the process transparent and resistant to fraud. In DeFi, blockchain not only supports the exchange of assets but also the execution of smart contracts, which automate and enforce the terms of a trade.

Role of Smart Contracts

Smart contracts are self-executing contracts with the terms of the agreement directly written into code. In P2P DeFi exchanges, they play a crucial role in automating trading processes, ensuring that transactions are completed once predetermined conditions are met. This automation reduces the need for intermediaries, thereby cutting down transaction costs and time.

Liquidity and Liquidity Pools

One of the challenges in P2P trading is ensuring there is enough liquidity for trades to occur without significant price slippage. DeFi exchanges address this through liquidity pools, where users lock their assets into a smart contract to provide liquidity in exchange for rewards. This system facilitates smoother and more efficient trading on P2P platforms.

Advantages of P2P in DeFi

The P2P model in DeFi exchanges offers several advantages, including reduced transaction costs, improved privacy, and increased accessibility. By removing centralized authorities, transactions become more direct and efficient. Moreover, this model often provides greater control over personal data and financial assets.

Security in P2P DeFi Exchanges

While P2P DeFi exchanges eliminate many risks associated with centralized entities, they also introduce new security considerations. The decentralized nature of these platforms requires robust security protocols to protect against hacks, fraud, and smart contract vulnerabilities.

The Future of P2P in DeFi

As DeFi continues to grow, the role of P2P exchanges is likely to become even more prominent. Ongoing developments aimed at enhancing scalability, security, and user experience are expected to drive wider adoption and innovation in the space.

The fundamentals of P2P in DeFi exchanges revolve around the core concepts of decentralization, direct user interaction, smart contract automation, and enhanced liquidity mechanisms. Understanding these basics is key to appreciating the innovative and transformative nature of these platforms.

Advantages of P2P in DeFi Exchanges

Peer-to-Peer (P2P) systems in Decentralized Finance (DeFi) exchanges bring a host of advantages that are reshaping the landscape of financial transactions. By leveraging the power of blockchain technology and smart contracts, P2P in DeFi exchanges offer benefits that are not typically found in traditional financial systems. Let’s delve into these advantages with clarity and precision.

Reduced Dependency on Intermediaries

One of the most significant advantages of P2P in DeFi exchanges is the reduced reliance on intermediaries. Traditional financial transactions often involve banks or brokers, which can add extra layers of complexity, time, and cost. P2P DeFi exchanges eliminate these middlemen, allowing users to interact and transact directly with one another. This leads to more efficient transactions with lower fees.

Enhanced Security and Privacy

DeFi exchanges built on P2P networks offer enhanced security and privacy. The decentralized nature of blockchain technology means that there is no central point of failure, making these systems less susceptible to hacking and fraud. Additionally, P2P transactions can be more private, as they often require less personal information than traditional financial systems.

Greater Accessibility and Inclusivity

P2P DeFi exchanges open up financial services to a broader audience, including those who are unbanked or underbanked. By removing the need for traditional banking infrastructure and allowing for lower entry barriers, these platforms can offer financial services to people regardless of their location or economic status.

Improved Market Efficiency

The direct nature of P2P trading in DeFi exchanges leads to improved market efficiency. Prices in these markets can adjust more rapidly and accurately reflect the true supply and demand since there is no intermediary artificially slowing down or skewing the process. This can lead to fairer pricing and more efficient markets.

Liquidity and Yield Farming Opportunities

P2P in DeFi exchanges introduce innovative ways to provide liquidity and earn rewards. Liquidity pools and yield farming are unique to the DeFi ecosystem, allowing users to earn returns on their crypto assets by providing liquidity to the market. This not only helps in maintaining healthy liquidity levels but also provides passive income opportunities for participants.

Programmable and Automated Transactions

The use of smart contracts in P2P DeFi exchanges allows for programmable and automated transactions. This means that certain conditions can be pre-set into a contract, and transactions will execute automatically when these conditions are met, streamlining the trading process and reducing the potential for human error.

Empowerment of Users

Finally, P2P in DeFi exchanges empower users by giving them more control over their financial transactions. In these decentralized systems, users have greater autonomy and flexibility in managing their assets, setting their terms, and choosing their trading partners.

The advantages of P2P in DeFi exchanges are considerable, offering a more efficient, secure, and inclusive alternative to traditional financial systems. As the DeFi sector continues to evolve, these benefits are likely to expand and attract more participants to the world of decentralized finance.

How P2P DeFi Exchanges Operate

Understanding how Peer-to-Peer (P2P) Decentralized Finance (DeFi) exchanges operate is key to appreciating the innovation they bring to the financial world. P2P in DeFi exchanges represent a significant shift from traditional financial exchange models, embracing a decentralized approach that leverages blockchain technology. This section will explore their operational mechanisms in an easy-to-understand, informative manner.

Decentralized Nature of P2P DeFi Exchanges

At the core of P2P DeFi exchanges is the principle of decentralization. Unlike traditional exchanges, which rely on a central authority to facilitate transactions, P2P DeFi exchanges operate on a distributed ledger technology, typically a blockchain. This means that transactions are processed and verified by a network of computers rather than a centralized body.

Role of Smart Contracts

Smart contracts are integral to the functioning of P2P DeFi exchanges. These are self-executing contracts with the terms of the agreement between buyer and seller directly written into lines of code. The code and the agreements contained therein exist across a distributed, decentralized blockchain network. Smart contracts automate the trading process, ensuring that transactions are executed once agreed-upon conditions are met, without the need for intermediaries.

Trading Process in P2P DeFi Exchanges

In a P2P DeFi exchange, a user typically starts by selecting a trading pair and placing an order. This order can either be a ‘buy’ or ‘sell’ order, with specific details such as price and quantity. Once an order is placed, the exchange’s algorithm matches the buyer and seller. When a match is found, the smart contract facilitates the exchange of assets directly between the two parties.

Liquidity Pools and Automated Market Makers (AMMs)

P2P DeFi exchanges often rely on liquidity pools and Automated Market Makers (AMMs) to facilitate trading. Users can contribute their assets to liquidity pools, which are then used to provide the necessary liquidity for trades. In return, liquidity providers earn a portion of the trading fees or other incentives. AMMs use algorithms to set prices in a liquidity pool, based on supply and demand, allowing for seamless trading without the need for a traditional market maker.

Token Swaps and Interoperability

Token swaps are a common feature in P2P DeFi exchanges, enabling users to easily exchange one type of cryptocurrency for another. Advanced DeFi platforms also offer interoperability across different blockchain networks, broadening the scope of trading possibilities and asset availability.

Security and Privacy Measures

Security and privacy are paramount in P2P DeFi exchanges. The decentralized nature of these platforms minimizes the risk of single points of failure. Additionally, advanced cryptographic techniques ensure transaction security and user privacy. However, users are also encouraged to exercise due diligence, as the decentralized nature of these platforms means less regulatory oversight.

In conclusion, P2P DeFi exchanges operate on the principles of decentralization, leveraging blockchain technology and smart contracts to facilitate direct, secure, and efficient transactions between users. Their innovative use of liquidity pools, AMMs, and token swaps has significantly altered the landscape of digital asset trading, offering a more accessible, transparent, and user-empowered financial ecosystem.

Security in P2P DeFi Exchanges

When it comes to Peer-to-Peer (P2P) Decentralized Finance (DeFi) exchanges, security is a paramount concern. The very nature of P2P in DeFi exchanges, which operate without centralized oversight, places a significant emphasis on the need for robust security measures. Understanding these security mechanisms is crucial for anyone engaging with these platforms. Let’s break down the key aspects of security in P2P DeFi exchanges.

Decentralization as a Security Feature

One of the inherent security features of P2P DeFi exchanges is their decentralized nature. Unlike traditional systems, where a central point of control can be a vulnerability, decentralized systems distribute data across a blockchain network. This makes it much more difficult for hackers to compromise the system as they would need to attack multiple nodes simultaneously.

Smart Contract Security

Smart contracts are the backbone of transactions in P2P DeFi exchanges, automating the execution of trades based on predefined conditions. However, the security of these contracts is crucial, as flaws or vulnerabilities can be exploited. Continuous auditing and testing of smart contracts are essential to ensure they function as intended and remain secure against potential attacks.

User-Controlled Security Measures

In P2P DeFi exchanges, much of the responsibility for security falls on the users. This includes the use of secure wallets, strong passwords, and being vigilant against phishing attacks. Users must also be aware of the smart contracts they interact with, as a compromised contract could lead to the loss of funds.

Encryption and Anonymity

Encryption plays a key role in securing transactions on P2P DeFi exchanges. Advanced cryptographic techniques are used to protect sensitive data and ensure transaction privacy. Additionally, the anonymity provided by blockchain technology can further safeguard user identities and transaction details from being compromised.

Challenges and Continuous Improvement

Despite these security measures, P2P DeFi exchanges are not immune to risks. The nascent nature of blockchain technology means that new vulnerabilities can emerge. As such, continuous improvement and adaptation of security measures are essential. This includes staying updated with the latest security developments and incorporating new technologies to safeguard the platforms.

While security in P2P DeFi exchanges is robust due to decentralization, encryption, and smart contract audits, it also requires active participation from users in safeguarding their assets. The dynamic nature of blockchain technology demands ongoing vigilance and adaptation to new security challenges.

Challenges and Risks in P2P DeFi Exchanges

While Peer-to-Peer (P2P) Decentralized Finance (DeFi) exchanges offer numerous benefits, they also come with their own set of challenges and risks. Understanding these is crucial for anyone participating in P2P in DeFi exchanges. This section will outline the primary challenges and risks, presented in a clear and informative manner.

Smart Contract Vulnerabilities

One of the core components of P2P DeFi exchanges is smart contracts. However, these contracts are only as secure as the code they are written in. Flaws or bugs in smart contract code can lead to vulnerabilities, potentially resulting in the loss of significant amounts of money. Regular audits and security checks are essential, but they cannot guarantee absolute safety.

Regulatory Uncertainty

The regulatory environment for P2P DeFi exchanges is still evolving. The lack of clear regulatory guidance can pose risks for both the platforms and their users. This includes potential legal challenges and the risk of future regulatory actions that could impact the operation and viability of DeFi platforms.

Market Volatility

P2P DeFi exchanges, like other cryptocurrency-related platforms, are subject to high market volatility. This volatility can be driven by a range of factors, including regulatory news, technological developments, and market sentiment. Such volatility can lead to rapid and significant price changes, posing a risk to traders and investors.

Liquidity Risks

Liquidity is crucial for the effective functioning of P2P DeFi exchanges. However, liquidity can sometimes be a challenge, particularly on newer or smaller platforms. Low liquidity can lead to issues like price slippage, where the actual transaction price differs significantly from the expected price at the time of order placement.

Risk of Impermanent Loss

In DeFi, especially in platforms utilizing Automated Market Makers (AMMs), there’s a risk known as “impermanent loss.” This occurs when the price of a token changes compared to when it was deposited in a liquidity pool, potentially leading to financial loss for liquidity providers.

See image below on how impermanent loss occurs in liquidity pools:

Security Risks

Despite the decentralized and encrypted nature of P2P DeFi exchanges, they are not immune to security risks. These include potential for hacking, phishing attacks, and other forms of cybercrime. Users need to be vigilant and adopt strong security practices to protect their assets.

User Error and Responsibility

In P2P DeFi exchanges, the user bears a greater responsibility for their actions. There is no centralized authority to reverse transactions in case of error. This increases the risk associated with user mistakes, such as sending funds to the wrong address or falling prey to scams.

While P2P in DeFi exchanges offer a revolutionary approach to financial exchanges, they come with inherent challenges and risks, including smart contract vulnerabilities, regulatory uncertainty, market volatility, liquidity risks, impermanent loss, security concerns, and the potential for user error. Awareness and understanding of these risks are vital for anyone engaging in these platforms.

Comparison with Traditional and Centralized Exchanges

When exploring the world of Peer-to-Peer (P2P) Decentralized Finance (DeFi) exchanges, it’s essential to understand how they differ from traditional and centralized exchanges. This comparison sheds light on the unique features and potential advantages of P2P in DeFi exchanges. Let’s break down the key differences in a straightforward and informative manner.

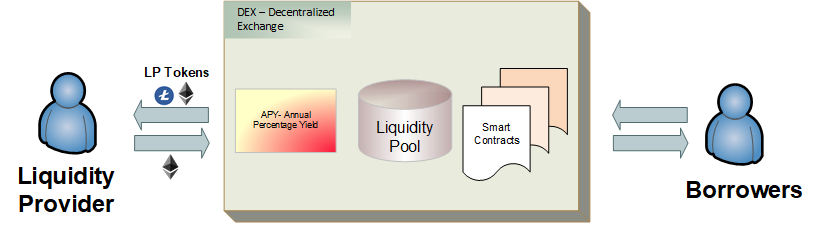

Centralization vs. Decentralization

The fundamental difference between traditional/centralized exchanges and P2P DeFi exchanges lies in their operational structure. Traditional exchanges are centralized, meaning they are managed by a central authority (like a company or an organization) that oversees and facilitates all transactions. In contrast, P2P DeFi exchanges operate on a decentralized network, typically a blockchain, where transactions occur directly between users without the need for an intermediary.

Below is side-by-side comparison diagram of centralized and decentralized exchange models:

Security and Control

Centralized exchanges, while generally user-friendly and efficient, have a single point of failure – their central server. This makes them more susceptible to hacking and other security breaches. P2P DeFi exchanges, on the other hand, distribute data across a blockchain network, significantly reducing the risk of a single point of failure and enhancing overall security. However, in DeFi, users are responsible for their own wallet security, which can be a double-edged sword.

Custody of Assets

In traditional exchanges, users typically relinquish control of their assets to the exchange, which can pose a risk if the exchange is compromised. P2P DeFi exchanges offer non-custodial trading, where users maintain control of their private keys and, by extension, their assets at all times.

Accessibility and Inclusivity

Traditional exchanges often have stringent registration and KYC (Know Your Customer) processes, which can be a barrier to entry for some users. P2P DeFi exchanges usually have lower barriers to entry, making them more accessible to a broader population, including those in unbanked or underbanked regions.

Liquidity and Market Depth

Centralized exchanges typically have higher liquidity and market depth due to their longer existence and larger user base. This can lead to better price stability and lower slippage. P2P DeFi exchanges, while growing rapidly, can sometimes struggle with liquidity issues, particularly in less popular trading pairs.

Transaction Speed and Costs

Transaction speeds can vary significantly between the two types. Centralized exchanges often have faster transaction speeds due to their optimized, centralized processing systems. P2P DeFi exchanges might experience slower transaction times, especially on congested networks, and can have higher transaction fees (gas fees) in times of network congestion.

Regulatory Oversight

Centralized exchanges are typically subject to regulatory oversight, which can provide a level of security and recourse for users. P2P DeFi exchanges operate in a more regulatory grey area, which can be both an advantage (less restriction) and a risk (less protection).

While P2P in DeFi exchanges offer greater decentralization, enhanced security in terms of data breaches, non-custodial asset control, and increased accessibility, they also face challenges like potential liquidity issues, variable transaction speeds, and less regulatory oversight. Understanding these differences is crucial for anyone navigating the cryptocurrency and digital asset trading space.

User Experience in P2P DeFi Exchanges

The user experience in Peer-to-Peer (P2P) Decentralized Finance (DeFi) exchanges is a critical aspect that determines their adoption and success. Unlike traditional financial systems, P2P in DeFi exchanges offer a unique set of experiences due to their decentralized nature. This section will explore these user experiences in a clear and informative manner.

Interface and Ease of Use

P2P DeFi exchanges vary greatly in terms of user interface and ease of use. While some platforms strive for simplicity and user-friendliness, others can be complex, particularly for users who are new to the world of DeFi and blockchain. The decentralized nature often means that users must manage their own wallets and private keys, which can be a daunting task for beginners.

Onboarding Process

The onboarding process on P2P DeFi exchanges is usually more straightforward compared to centralized exchanges. Most DeFi platforms do not require extensive KYC (Know Your Customer) processes, allowing users to start trading with just a wallet address. This can be both a benefit (in terms of ease and privacy) and a drawback (lack of recourse in case of disputes).

Transaction Speed and Costs

Transaction speeds in P2P DeFi exchanges can be variable, often depending on the congestion of the underlying blockchain network. Additionally, transaction costs (such as Ethereum gas fees) can fluctuate, which might impact the overall trading experience, especially during times of high network demand.

Personal Responsibility and Control

In P2P DeFi exchanges, users have more control over their assets, as they are not held by a central authority. However, this also means greater personal responsibility for security and decision-making. Users need to be vigilant about security practices, smart contract interactions, and understanding the risks associated with trading.

Accessibility and Global Reach

One of the significant advantages of P2P DeFi exchanges is their global accessibility. Users from different parts of the world can access these platforms without the need for traditional banking systems. This inclusivity is a huge step forward in democratizing finance.

Community and Support

The community-driven nature of many P2P DeFi exchanges is another unique aspect of the user experience. These platforms often have active communities where users can seek support, share insights, and contribute to the platform’s development. However, the level of formal customer support can vary compared to centralized exchanges.

Learning Curve

There is typically a steeper learning curve associated with P2P DeFi exchanges. Users need to educate themselves about various aspects, including wallet security, smart contract risks, and the dynamics of liquidity pools and yield farming.

The user experience in P2P DeFi exchanges is marked by a blend of greater control, increased privacy, global accessibility, and community involvement, balanced against the need for self-reliance, security awareness, and understanding complex systems. As the DeFi space continues to evolve, these experiences are likely to become more refined and user-friendly.

Role of Liquidity in P2P DeFi Exchanges

Liquidity is a crucial element in the functionality and success of Peer-to-Peer (P2P) Decentralized Finance (DeFi) exchanges. Understanding the role of liquidity in these platforms is essential for anyone participating in P2P in DeFi exchanges. This section aims to elucidate the concept of liquidity in DeFi and its importance in a straightforward and informative manner.

What is Liquidity?

In financial terms, liquidity refers to the ease with which an asset can be converted into cash or another asset without affecting its market price. In the context of P2P DeFi exchanges, liquidity is about how easily crypto assets can be traded or swapped within the platform.

Importance of Liquidity in P2P DeFi Exchanges

High liquidity is vital in P2P DeFi exchanges as it ensures smoother transactions, more stable prices, and less slippage (the difference between the expected price of a trade and the price at which the trade is executed). Adequate liquidity makes it easier for users to buy or sell assets quickly and at predictable prices, enhancing the overall efficiency and attractiveness of the exchange.

Liquidity Pools

Liquidity pools are the backbone of providing liquidity in many P2P DeFi exchanges. These are pools of tokens locked in a smart contract that facilitate trading by providing liquidity. Users, known as liquidity providers (LPs), contribute assets to these pools and in return, they earn trading fees based on the amount of liquidity they provide.

Automated Market Makers (AMMs)

Automated Market Makers (AMMs) are an integral part of P2P DeFi exchanges, especially in providing liquidity. Unlike traditional market-making mechanisms, AMMs use algorithms to set prices in the liquidity pool based on a mathematical formula. This automated process helps maintain constant liquidity, enabling trading even in less popular asset pairs.

Risks Associated with Liquidity Provision

While providing liquidity can be lucrative, it also comes with risks such as impermanent loss, which occurs when the price of the deposited assets changes compared to when they were deposited. Understanding these risks is crucial for anyone considering becoming a liquidity provider.

The Impact of Liquidity on User Experience

The level of liquidity in a P2P DeFi exchange directly impacts the user experience. High liquidity leads to a more efficient and user-friendly experience, with quicker trades and less price slippage. Conversely, low liquidity can result in a frustrating experience due to slower and less predictable trades.

Liquidity plays a pivotal role in the operation and success of P2P DeFi exchanges. It not only affects the efficiency and stability of trading but also significantly influences the overall user experience. Understanding and managing the aspects of liquidity, including its provision and associated risks, are key for participants in these innovative financial platforms.

Impact of Regulations on P2P DeFi Exchanges

The regulatory landscape has a significant impact on Peer-to-Peer (P2P) Decentralized Finance (DeFi) exchanges. As these platforms continue to grow in popularity, understanding the influence of regulations on P2P in DeFi exchanges is crucial. This section aims to provide a clear and informative overview of how regulations affect these innovative financial platforms.

The Current State of Regulation in DeFi

DeFi, being a relatively new and rapidly evolving sector, often operates in a grey area of financial regulation. Many countries and financial authorities are still in the process of understanding and determining how to regulate these decentralized platforms. The lack of clear regulatory frameworks can lead to uncertainty both for the platforms themselves and their users.

Challenges in Regulating P2P DeFi Exchanges

Regulating P2P DeFi exchanges poses unique challenges. The decentralized and often anonymous nature of these platforms makes it difficult to apply traditional financial regulatory measures. Key issues include ensuring consumer protection, preventing money laundering, and maintaining financial stability while not stifling innovation.

Potential Benefits of Regulation

Appropriate regulation can bring several benefits to P2P DeFi exchanges. It can provide greater legitimacy and trust in these platforms, potentially attracting a broader user base, including institutional investors. Regulation can also offer a degree of protection for consumers, ensuring that DeFi operates within certain ethical and financial standards.

Impact on Innovation and Growth

There is a delicate balance to be struck between regulation and innovation. Overly stringent regulations could hinder the growth and innovation that characterize the DeFi sector. It’s crucial for regulators to understand the technology and its potential to create frameworks that support responsible innovation.

The Future of Regulation in DeFi

Looking ahead, it’s likely that we will see more defined regulatory frameworks emerging for P2P DeFi exchanges. The challenge will be to develop regulations that ensure safety and transparency while allowing the DeFi sector to continue its path of innovative financial solutions.

The Role of the DeFi Community

The DeFi community, including developers, users, and industry experts, can play a role in shaping future regulations. By engaging with regulators and participating in the legislative process, the community can help create a regulatory environment that is both fair and conducive to growth.

The impact of regulations on P2P in DeFi exchanges is multifaceted, affecting everything from user trust to innovation. While the regulatory landscape is still evolving, it’s clear that regulations will play a crucial role in shaping the future of DeFi. Navigating this landscape requires a collaborative effort between regulators, industry participants, and the broader community.

Innovations and Future Trends

The landscape of Peer-to-Peer (P2P) Decentralized Finance (DeFi) exchanges is continually evolving, with innovations shaping the future of how we view and interact with financial systems. Keeping abreast of these innovations and trends is crucial for anyone involved in P2P in DeFi exchanges. This section will explore some of the most significant developments and what they might mean for the future.

Emerging Technologies in DeFi

Blockchain technology, the foundation of DeFi, is continually advancing. Innovations like layer 2 solutions and cross-chain interoperability are addressing current limitations in scalability and efficiency. These technologies aim to enhance transaction speeds and reduce costs, making DeFi more accessible and practical for a broader user base.

Integration with Traditional Finance

A growing trend is the convergence of DeFi with traditional financial systems. This integration can take many forms, from tokenization of traditional assets to the creation of decentralized versions of conventional financial instruments. This trend could significantly broaden the scope and appeal of DeFi, making it more accessible and relevant to the general public.

Enhanced User Experience and Accessibility

Improving the user experience is a critical focus area for DeFi platforms. Future developments are likely to include more intuitive interfaces, better educational resources, and improved customer support. These enhancements are essential to reduce the entry barriers for new users and increase adoption rates.

Advanced Security Measures

As the DeFi space grows, so does the need for robust security measures. Innovations in cryptographic security, smart contract auditing, and insurance protocols are critical areas of focus. These developments aim to protect users from hacks, fraud, and other security threats, which are paramount for the long-term sustainability of DeFi.

Regulatory Developments

The evolution of regulatory frameworks will significantly impact the future of DeFi. As governments and financial authorities develop clearer guidelines, we can expect more standardized practices and perhaps even new forms of DeFi-specific regulation. These changes will likely influence how DeFi platforms operate and how they are perceived by potential users.

Decentralized Governance Models

The future of DeFi could see more platforms adopting decentralized governance models. These models empower users to have a say in the development and decision-making processes of the platform, aligning with the ethos of decentralization and community-driven innovation.

The Role of Artificial Intelligence (AI)

AI and machine learning could play an increasingly important role in DeFi. From predictive analytics to automated trading strategies, the integration of AI could open up new possibilities and efficiencies within DeFi platforms.

The future of P2P in DeFi exchanges is vibrant and full of potential, driven by technological advancements, regulatory developments, and a commitment to improving user experience. As the landscape continues to evolve, staying informed about these innovations and trends will be crucial for anyone involved in the world of DeFi.

Real-World Examples and Case Studies

Exploring real-world examples and case studies is an effective way to understand the impact and practical applications of Peer-to-Peer (P2P) Decentralized Finance (DeFi) exchanges. These examples highlight how P2P in DeFi exchanges operates in real scenarios, providing valuable insights into their functionality, benefits, and challenges. Let’s delve into some notable examples and case studies.

Example 1: Uniswap – Revolutionizing Token Swaps

Uniswap is a leading example of a P2P DeFi exchange that has gained significant popularity. It utilizes an automated liquidity protocol, allowing users to swap various Ethereum-based tokens without the need for traditional market makers. Uniswap’s success demonstrates the power of AMMs (Automated Market Makers) in providing liquidity and facilitating efficient token exchanges.

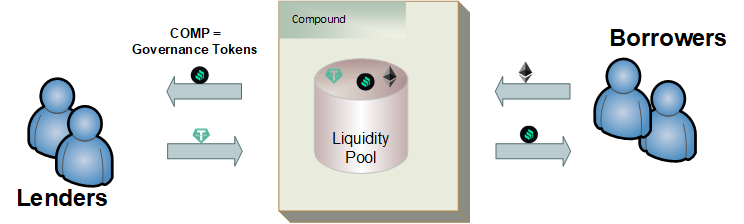

Example 2: Compound – Lending and Borrowing

Compound is another prominent player in the DeFi space, offering decentralized lending and borrowing services. Users can supply assets to the platform’s liquidity pool and earn interest or borrow against their crypto holdings. This platform exemplifies the innovative use of smart contracts in creating decentralized lending systems.

Case Study: Decentralized Finance in Emerging Markets

A notable case study is the adoption of DeFi in emerging markets. In regions with limited access to traditional banking, DeFi platforms are offering new avenues for financial inclusion. For instance, users in these markets are leveraging DeFi for remittances, accessing credit, and earning interest on their digital assets, all facilitated through P2P transactions.

Example 3: MakerDAO – Stablecoin and Governance

MakerDAO is a critical project in DeFi, known for its stablecoin, DAI. It operates as a decentralized credit platform on Ethereum, allowing users to lock up assets and generate DAI as a loan against them. MakerDAO’s governance model, where holders of its MKR token have voting rights, is an excellent example of decentralized decision-making.

Case Study: DeFi’s Role in Financial Crises

An interesting case study is the role of DeFi during financial crises. In times of economic instability, P2P DeFi exchanges have provided an alternative for individuals to manage and diversify their assets, hedge against inflation, and access global markets, bypassing local economic constraints.

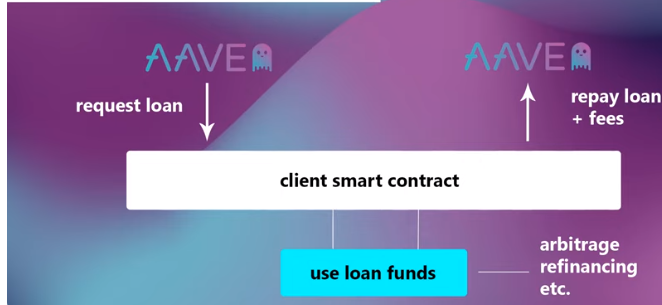

Example 4: Aave – Flash Loans

Aave stands out for its introduction of flash loans – loans that are issued and repaid within a single transaction. This innovation demonstrates the potential for DeFi to offer novel financial products that are not feasible in traditional finance.

An infographic image below explaining the concept of Aave flash loans:

These real-world examples and case studies illustrate the diverse applications and significant potential of P2P in DeFi exchanges. From token swaps to innovative lending solutions, these platforms are not only advancing the world of finance but also contributing to greater financial inclusion and resilience.

How to Get Started with P2P DeFi Exchanges

For those new to the world of decentralized finance, beginning with Peer-to-Peer (P2P) Decentralized Finance (DeFi) exchanges can seem daunting. However, with the right guidance, the process can be straightforward. This section aims to provide a clear and concise guide on how to get started with P2P in DeFi exchanges.

Step 1: Understanding the Basics

Before diving in, it’s essential to have a basic understanding of what DeFi and P2P exchanges are. Familiarize yourself with key concepts like blockchain, smart contracts, liquidity pools, and the principles of decentralized finance. This foundational knowledge will help you navigate the DeFi space more effectively.

Step 2: Setting Up a Digital Wallet

To interact with P2P DeFi exchanges, you’ll need a digital wallet that supports cryptocurrency transactions. Wallets like MetaMask, Trust Wallet, or Ledger are popular choices. Ensure that your chosen wallet is compatible with the DeFi platforms you intend to use.

Step 3: Acquiring Cryptocurrency

You will need to have some cryptocurrency, such as Ethereum (ETH), to start using most DeFi platforms. You can buy cryptocurrency from a traditional exchange and then transfer it to your digital wallet. Be aware of the network fees and transfer times involved.

Step 4: Choosing a P2P DeFi Exchange

There are many P2P DeFi exchanges available, each with unique features and offerings. Research and choose a platform that aligns with your needs, whether it’s token swapping, lending, borrowing, or liquidity provision. Consider factors like transaction fees, supported assets, and user reviews.

Step 5: Connecting Your Wallet to the Exchange

To participate in a DeFi exchange, connect your digital wallet to the platform. This usually involves visiting the exchange’s website and selecting the option to connect a wallet. Follow the prompts to securely link your wallet.

Step 6: Start Trading or Investing

Once your wallet is connected, you can start trading or investing on the platform. This could involve swapping tokens, providing liquidity, or participating in other financial activities offered by the exchange. Always start with small amounts to get a feel for the process and the platform’s functionality.

Step 7: Staying Informed and Safe

DeFi is an evolving space, and staying informed is crucial. Keep up with the latest trends, updates, and security practices. Always be cautious and do your due diligence before investing significant amounts.

Final Thoughts

Getting started with P2P in DeFi exchanges involves educating yourself, setting up the necessary tools, choosing the right platforms, and engaging with the ecosystem in a secure and informed manner. With these steps, you can embark on your journey into the innovative world of decentralized finance.

Conclusion and Final Thoughts

As we’ve explored the dynamic and innovative world of Peer-to-Peer (P2P) Decentralized Finance (DeFi) exchanges, it’s clear that this burgeoning sector represents a significant shift in the financial landscape. P2P in DeFi exchanges are not just a technological novelty but a movement towards a more open, inclusive, and decentralized financial system.

The journey through understanding the fundamentals, advantages, operational mechanisms, and security aspects of P2P DeFi exchanges highlights the profound impact these platforms can have on traditional finance. From offering enhanced liquidity and financial inclusion to fostering innovation through smart contracts and automated market makers, DeFi is paving the way for a future where finance is more accessible, transparent, and aligned with the ethos of decentralization.

However, as with any emerging technology, navigating the world of DeFi comes with its challenges and risks. The evolving regulatory landscape, the need for improved user experiences, and the paramount importance of security are all areas that require careful consideration and ongoing development.

For those looking to get started with P2P DeFi exchanges, the journey begins with education and a cautious approach to navigating this new frontier. By understanding the underlying technologies, choosing the right platforms, and staying informed about the latest developments and best practices, individuals can participate in the DeFi ecosystem more confidently and securely.

In conclusion, P2P in DeFi exchanges offer a glimpse into the future of finance — one that is decentralized, democratized, and driven by the community. As this sector continues to evolve, it promises to bring about significant changes to how we save, invest, and transact. By embracing these innovations, we can all be part of shaping a financial system that is more aligned with the values of autonomy, transparency, and inclusive.