Introduction

In the intricate world of investment, the strategy of “Combining Fundamental Analysis, Macro Analysis, Technical Analysis, and On-Chain Analysis” is rapidly gaining traction among savvy investors seeking a more holistic approach to market analysis. This blog post delves into the nuances of integrating these diverse yet complementary analytical methods to offer a well-rounded perspective on investing. Whether you’re a seasoned investor or new to the financial markets, understanding how to effectively merge these techniques can significantly enhance your investment decision-making process, providing a balanced view of opportunities and risks across various asset classes. Let’s explore how this combined approach can revolutionize your investment strategy and help you navigate the complexities of the modern financial landscape.

Table of Contents

Understanding Each Analysis Type

When delving into the world of financial analysis, it’s crucial to understand the distinct methodologies used to evaluate and predict market behaviors. This understanding forms the foundation for effectively combining Fundamental Analysis, Macro Analysis, Technical Analysis, and On-Chain Analysis – a synergy that can provide unparalleled insights into financial markets.

Fundamental Analysis

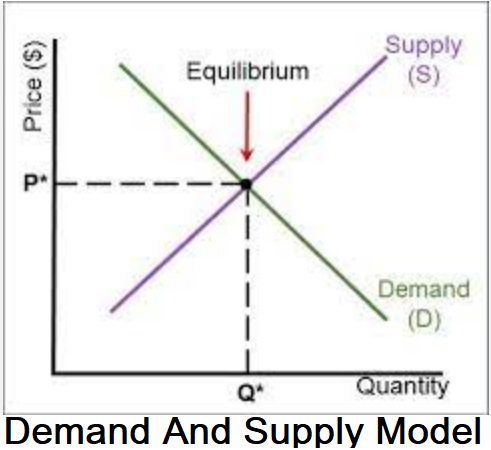

Fundamental Analysis is a method used primarily in stock market investing. It involves evaluating a company’s financial health and intrinsic value by analyzing its financial statements, management, industry conditions, and economic factors. This approach is based on the assumption that a company’s stock price does not always reflect its true value. Analysts look at revenues, earnings, future growth, return on equity, profit margins, and other data to determine a company’s underlying value and potential for future growth.

The Image below depicts PE Ratio vs Fair Price of Sibanye Stillwater Limited (SSW) From Johannesburg Stock Exchange (JSE) :

Macro Analysis

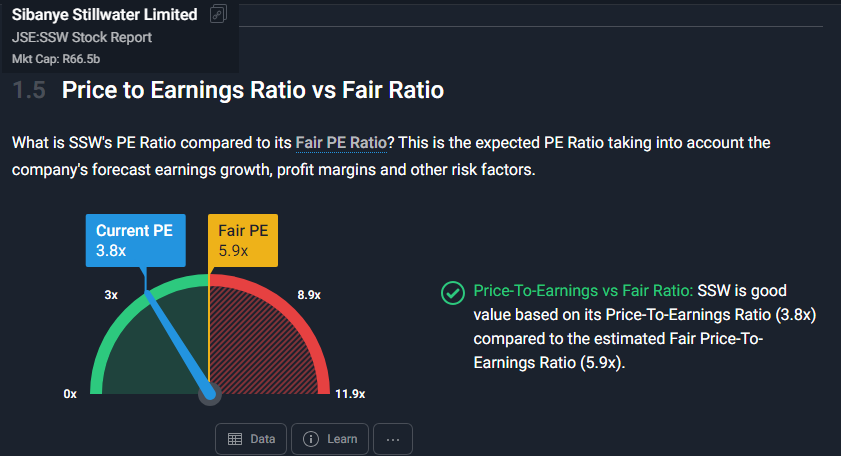

Macro Analysis takes a broader approach, focusing on economic conditions and how they influence the financial markets. This type of analysis examines macroeconomic indicators such as GDP, unemployment rates, inflation, government policies, and economic cycles. The goal is to understand how these macroeconomic factors affect industries, markets, and individual securities. Investors and analysts use this information to make predictions about market trends and to identify potential investment opportunities.

The Image below shows US ISM Purchasing Managers Index (PMI):

Technical Analysis

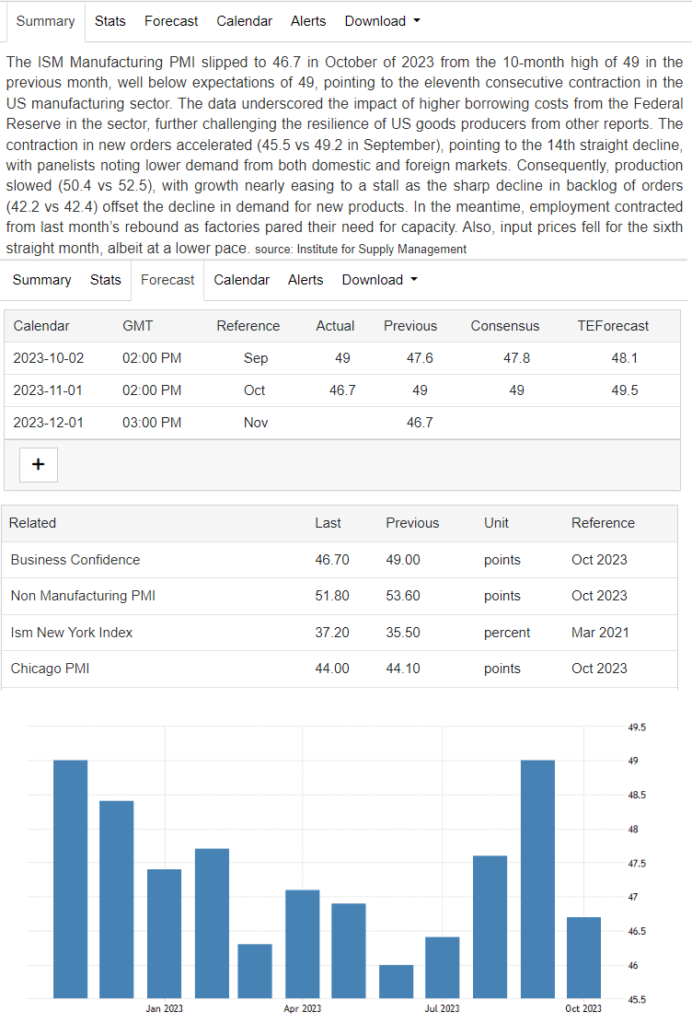

Technical Analysis is a methodology that predicts the direction of prices through the study of past market data, primarily price and volume. It’s widely used by traders in stock, forex, and commodity markets. This approach relies on patterns and market trends, using various charts and statistical indicators like moving averages, Relative Strength Index (RSI), and Bollinger Bands. The core belief behind technical analysis is that historical price movements can indicate future market trends.

The Image below illustrate Bitcoin/U.S. Dollar, MA Indicator, Descending wedge pattern and Trend lines:

On-Chain Analysis

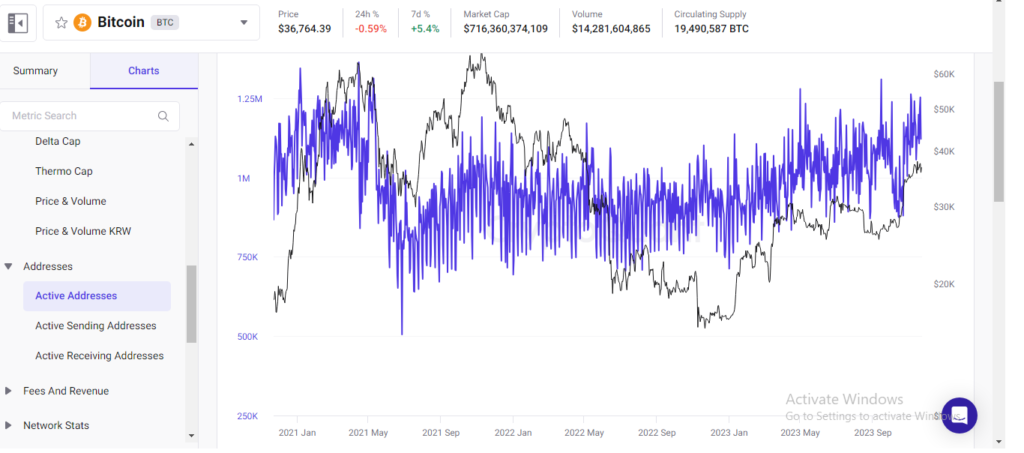

Specific to the world of cryptocurrency, On-Chain Analysis involves examining transaction data on a blockchain. It looks at various metrics such as transaction volume, active addresses, and token distribution to gauge the health and strength of a cryptocurrency or a blockchain network. This analysis provides insights into investor behavior, network utility, and potential price movements of digital assets.

The Image below is a visual representation of On-Chain Data showing Bitcoin Active Addresses :

Understanding each of these analysis types is critical in developing a comprehensive approach to market analysis. By “Combining Fundamental Analysis, Macro Analysis, Technical Analysis, and On-Chain Analysis,” investors and analysts can gain a more nuanced and holistic view of the markets, leading to more informed investment decisions.

Combining Fundamental Analysis, Macro Analysis, Technical Analysis, and On-Chain Analysis: The Synergy

In the world of financial analysis, the integration of different methodologies can provide a more rounded and comprehensive view of the market. “Combining Fundamental Analysis, Macro Analysis, Technical Analysis, and On-Chain Analysis” leverages the strengths of each approach, creating a synergy that can lead to more insightful investment decisions.

The Benefit of Integration

Each analysis type brings its own perspective:

- Fundamental Analysis offers a deep dive into a company’s financial health.

- Macro Analysis zooms out to consider the broader economic environment.

- Technical Analysis focuses on price movements and market trends.

- On-Chain Analysis provides a window into the dynamics of cryptocurrency markets.

By combining these analyses, investors can gain a holistic understanding of market dynamics. For instance, Fundamental and Macro Analysis can identify undervalued companies in a growing economic sector, while Technical Analysis can pinpoint the optimal entry and exit points for trading. On-Chain Analysis adds another layer, particularly useful in the crypto space, to assess network health and token valuation.

Practical Application

The practical application of this combined approach involves several steps:

- Macro and Fundamental Analysis: Begin with a macroeconomic overview to understand the current economic climate, then drill down into individual companies or assets using fundamental analysis.

- Technical Analysis: Use technical indicators to assess market sentiment and potential price movements, adding timing to your fundamental insights.

- On-Chain Analysis (for crypto assets): If dealing with cryptocurrencies, on-chain metrics can provide unique insights into network activity and investor behavior, further informing your decision.

Overcoming Challenges

While combining these analyses can be powerful, it also poses challenges, primarily in terms of data overload and conflicting signals. A balanced approach, focusing on the integration of complementary insights, is crucial to navigate these complexities.

Combining Fundamental Analysis, Macro Analysis, Technical Analysis, and On-Chain Analysis is not just about accumulating data from different sources. It’s about creating a synergy where the whole is greater than the sum of its parts. This integrated approach enables investors and analysts to make well-informed decisions, backed by a comprehensive understanding of the various forces shaping the markets.

Data Interpretation and Integration

In the process of “Combining Fundamental Analysis, Macro Analysis, Technical Analysis, and On-Chain Analysis,” the interpretation and integration of data from these diverse methodologies are paramount. This convergence is not just about collecting information from various sources; it’s about synthesizing this data in a meaningful way to provide comprehensive insights.

Interpreting Data Across Methods

Each analysis type contributes unique data sets:

- Fundamental Analysis provides financial metrics such as earnings, debt levels, and profit margins.

- Macro Analysis offers insights into broader economic indicators like GDP growth, inflation rates, and unemployment figures.

- Technical Analysis contributes data on price trends and patterns, through charts and indicators like moving averages or RSI.

- On-Chain Analysis (specific to cryptocurrencies) brings in data about transaction volumes, wallet activities, and token distribution.

Integrating Data for Comprehensive Insights

The integration process involves correlating these different data types to paint a complete picture of the market. For example, macroeconomic indicators can provide context for a company’s financial performance. Technical signals can help in timing the market based on underlying fundamental and macroeconomic conditions. In the crypto market, on-chain metrics can be used alongside traditional analysis to gauge investor sentiment and network health.

Steps for Effective Data Integration

- Collect and Filter Data: Gather relevant data from each analysis method, focusing on the most impactful metrics.

- Correlate Findings: Look for correlations between different data types. For instance, how macroeconomic trends are affecting a company’s performance, or how technical patterns align with fundamental indicators.

- Synthesize Insights: Combine these correlations into actionable insights. This might involve using macro and fundamental data to select a stock, then using technical analysis to decide on entry and exit points.

Challenges in Data Integration

Integrating data from multiple sources can be challenging, especially in terms of ensuring data accuracy and managing conflicting signals. It requires a deep understanding of each method and the ability to discern which data points are most relevant to the investment thesis.

The key to successfully combining Fundamental Analysis, Macro Analysis, Technical Analysis, and On-Chain Analysis lies in effective data interpretation and integration. It’s a process that requires not only analytical acumen but also a nuanced understanding of how different market forces interact.

Risk Management through Combined Analysis

Effective risk management is a cornerstone of successful investing, and “Combining Fundamental Analysis, Macro Analysis, Technical Analysis, and On-Chain Analysis” significantly enhances this aspect. Each analysis type brings a different perspective on risk, and when integrated, they provide a more robust risk assessment framework.

Leveraging Multiple Analysis Types for Risk Assessment

- Fundamental Analysis helps in assessing the intrinsic risk of an investment by evaluating a company’s financial health and growth prospects. For instance, a strong balance sheet and consistent earnings growth suggest lower financial risk.

- Macro Analysis adds a layer by evaluating risks stemming from economic conditions and geopolitical events. Understanding the macroeconomic environment helps in anticipating market-wide risks.

- Technical Analysis contributes by identifying market sentiment and trends, which can signal potential risks like high volatility or market reversals.

- On-Chain Analysis, specific to cryptocurrencies, assesses the network-related risks, including transaction volumes and wallet activities, indicating the asset’s stability and investor sentiment.

Integrating Risk Perspectives

By combining these approaches, investors can develop a comprehensive risk profile for their investments. For example, a fundamentally strong company might still be a risky investment in an unstable macroeconomic environment. Similarly, technical analysis might signal short-term trading risks that are not apparent from fundamental or macro analysis.

Implementing a Combined Risk Management Strategy

- Cross-Validation: Use insights from one method to validate or challenge findings from another. For example, if fundamental analysis identifies a stock as a strong buy, but technical analysis shows a bearish trend, it could signal a need for caution.

- Diversification: Understanding risks across different analysis methods supports more effective diversification. It’s not just about diversifying assets but also diversifying the types of risks.

- Dynamic Risk Assessment: Markets are dynamic, and so should be the risk assessment. Regularly update the risk profile of investments by revisiting each analysis type.

Challenges and Considerations

Combining these analyses for risk management requires skill and experience. There’s a need to balance different risk indicators and not to overemphasize one at the expense of others. Additionally, managing the sheer volume of data can be challenging.

Combining Fundamental Analysis, Macro Analysis, Technical Analysis, and On-Chain Analysis creates a multi-dimensional approach to risk management. This approach not only identifies a broader range of risks but also offers a more nuanced understanding of their interplay.

Market Predictions and Performance

In the dynamic world of investing, accurately predicting market performance is key to success. “Combining Fundamental Analysis, Macro Analysis, Technical Analysis, and On-Chain Analysis” offers a multi-faceted approach to making informed market predictions. This combined methodology not only enhances the accuracy of predictions but also aids in understanding the various drivers of market performance.

Learn more about Thomas Kralow in our previous review of the man.

Learn Enhancing Predictive Accuracy with Combined Analysis

- Fundamental Analysis provides insights into a company’s potential for long-term growth and sustainability, helping investors identify fundamentally strong stocks that are likely to perform well over time.

- Macro Analysis enables investors to understand how broader economic conditions and policies may impact the market, aiding in predictions about market trends and sector performance.

- Technical Analysis offers tools for short-term market predictions by analyzing price patterns and trends. This is particularly useful for traders looking to capitalize on market movements.

- On-Chain Analysis is crucial for predicting the performance of cryptocurrencies. It offers insights into investor behavior and network health, which are significant drivers of price movements in the crypto market.

Synergizing for Superior Market Insight

The real power lies in synthesizing these approaches:

- Cross-Analysis Correlation: For instance, a fundamentally strong company in a thriving sector, showing bullish patterns in technical analysis, is more likely to be a good investment.

- Balancing Short-term and Long-term Predictions: While technical analysis may suggest short-term trades, fundamental and macro analyses provide a view of long-term potential, offering a balanced investment strategy.

- Cryptocurrency Market Specifics: In the crypto market, combining on-chain analysis with other methods can reveal deeper insights into token valuations and potential market movements.

Implementing Combined Analysis for Market Predictions

- Data Integration and Analysis: Regularly integrate and analyze data from all four methodologies to keep abreast of potential market changes.

- Adaptive Strategies: Be prepared to adapt strategies based on combined analysis, as markets can shift rapidly due to various factors.

Challenges to Consider

While this integrated approach offers comprehensive insights, it also comes with challenges such as data overload and conflicting signals from different analysis types. Navigating these challenges requires skill and experience.

Using combination of Fundamental Analysis, Macro Analysis, Technical Analysis, and On-Chain Analysis as a strategy enhances the ability to make more accurate market predictions and understand market performance. Don’t you think? It provides a holistic view of the market, allowing investors to make more informed decisions. Would you agree?

Time Horizon and Strategy Alignment

One of the key aspects of successful investing is aligning your strategy with your investment time horizon. “Combining Fundamental Analysis, Macro Analysis, Technical Analysis, and On-Chain Analysis” allows investors to tailor their strategies to fit different time frames, enhancing the potential for success across various investment horizons.

Tailoring Strategies to Time Horizons

- Short-term Investments: For investors looking at short-term gains, Technical Analysis plays a crucial role. It helps in identifying quick market entry and exit points based on price trends and patterns. On-Chain Analysis, particularly in the cryptocurrency domain, can also provide timely insights into short-term market sentiment.

- Medium-term Strategies: In medium-term investments, Macro Analysis becomes more significant. Understanding economic cycles, interest rate trends, and other macroeconomic factors can help in making informed decisions for investments spanning several months to a few years.

- Long-term Investments: Fundamental Analysis is the cornerstone of long-term investment strategies. Evaluating a company’s financial health, growth prospects, and industry position provides insights for investments with a horizon of several years.

Integrating Analyses for a Comprehensive Strategy

A comprehensive investment strategy often involves combining these analyses to benefit from different time horizons. For instance, an investor might use Fundamental Analysis to select a robust stock and then apply Technical Analysis to determine the best time to buy or sell that stock. Similarly, Macro Analysis can inform decisions about sector allocations, while On-Chain Analysis can provide additional insights for cryptocurrency investments.

Considerations for Strategy Alignment

- Balancing Diverse Insights: When combining different analyses, it’s important to balance their insights appropriately according to your investment time horizon.

- Regular Review and Adjustment: Investment strategies should be reviewed and adjusted regularly to align with changing market conditions and economic indicators.

Effectively “Combining Fundamental Analysis, Macro Analysis, Technical Analysis, and On-Chain Analysis” enables investors to create strategies that are well-aligned with their investment time horizons. This approach ensures that investors are not just relying on a single perspective but are considering various factors that influence market dynamics over different periods.

Application in Different Market Conditions

Adapting investment strategies to different market conditions is a critical skill for investors. The approach of “Combining Fundamental Analysis, Macro Analysis, Technical Analysis, and On-Chain Analysis” equips investors with the versatility to navigate various market scenarios effectively.

Adapting to Market Volatility

- Bull Markets: In rising markets, Fundamental Analysis can identify stocks with strong growth potential. Technical Analysis helps in timing entries and exits to maximize gains. Macro Analysis is crucial for understanding the broader economic factors driving the bull market.

- Bear Markets: During downturns, Macro Analysis becomes vital in assessing the broader economic impact. Fundamental Analysis aids in identifying undervalued stocks that may withstand market pressures. Technical Analysis can be used to identify downtrends and potential recovery points.

- Sideways Markets: In range-bound markets, Technical Analysis can be particularly useful for identifying stocks that are fluctuating within a certain range. Fundamental Analysis can help in picking stocks that have strong fundamentals and are likely to break out of the range.

- Cryptocurrency Markets: In the highly volatile cryptocurrency market, On-Chain Analysis provides real-time insights into investor behavior and network health, complementing the other analysis methods.

Customizing Strategies for Market Conditions

Customization of investment strategies based on market conditions involves:

- Identifying Market Trends: Use Macro and Technical Analysis to identify current market trends and adjust strategies accordingly.

- Stock Selection: Use Fundamental Analysis to select stocks or assets that align with the identified market trend.

- Timing Investments: Apply Technical Analysis for timing the entry and exit points, especially in short-term and medium-term investments.

- Cryptocurrency Investments: In the crypto market, use On-Chain Analysis to gauge market sentiment and network activity, supplementing it with other analysis types for a rounded view.

The strategy of “Combining Fundamental Analysis, Macro Analysis, Technical Analysis, and On-Chain Analysis” is immensely beneficial in adapting to varying market conditions. This comprehensive approach enables investors to make informed decisions, whether in a bull, bear, or sideways market, and in the ever-changing landscape of cryptocurrency.

Tools and Software for Combined Analysis

In today’s digital age, a variety of tools and software have emerged to facilitate “Combining Fundamental Analysis, Macro Analysis, Technical Analysis, and On-Chain Analysis.” These tools help in efficiently processing vast amounts of data, providing comprehensive insights that would be challenging to compile manually.

Essential Tools for Integrated Analysis

- Financial and Economic Data Platforms: These platforms provide extensive data for Fundamental and Macro Analysis, including financial statements, economic indicators, and market data. Examples include Bloomberg Terminal, Reuters Eikon, and Trading Economics.

- Technical Analysis Software: Tools like TradingView and MetaTrader offer advanced charting capabilities, technical indicators, and analytical tools, essential for Technical Analysis.

- Cryptocurrency Analysis Tools: For On-Chain Analysis, platforms like Glassnode or Coin Metrics offer in-depth blockchain data, including transaction volumes, wallet activities, and other on-chain metrics.

- Integrated Analysis Platforms: Some platforms combine these different types of data and analysis. They offer a unified interface for conducting Fundamental, Macro, Technical, and On-Chain Analysis, providing an all-in-one solution for investors.

Benefits of Using Advanced Analysis Tools

- Time Efficiency: Automated tools process and analyze data much faster than manual methods.

- Data Accuracy: These tools offer precise and up-to-date market data, reducing the risk of errors.

- Comprehensive Analysis: Integrated platforms allow for seamless combination of different types of analysis, offering a more complete view of the market.

- Customization and Flexibility: Many tools offer customization options, allowing investors to tailor the analysis to their specific needs.

Utilizing the right tools and software is key to effectively “Combining Fundamental Analysis, Macro Analysis, Technical Analysis, and On-Chain Analysis.” These tools not only simplify the analysis process but also enhance the accuracy and depth of market insights.

Developing a Combined Analysis Framework

Creating a framework for “Combining Fundamental Analysis, Macro Analysis, Technical Analysis, and On-Chain Analysis” is essential for investors seeking a comprehensive approach to market analysis. This integrated framework should harmonize the different methodologies to provide a balanced and insightful perspective on investments.

Steps to Develop a Combined Analysis Framework

- Define Objectives and Time Horizon: Start by defining your investment objectives and time horizon. This will guide the relative emphasis on each analysis type in your framework.

- Gather and Organize Data Sources: Identify and organize your sources for fundamental, macroeconomic, technical, and on-chain data. Ensure that you have reliable and up-to-date information.

- Create an Integration Process: Develop a process for how each type of analysis will feed into your investment decisions. This could involve initially using macro and fundamental analysis for asset selection, followed by technical analysis for timing, and on-chain analysis for additional insights in the case of cryptocurrencies.

- Build a Decision-Making Model: Construct a decision-making model that incorporates inputs from each type of analysis. This model should help in evaluating investment opportunities and risks from a multi-dimensional perspective.

- Implement Continuous Monitoring and Adjustment: Market conditions change, so continuous monitoring of these conditions through your combined analysis framework is crucial. Be prepared to adjust your model as new data and market trends emerge.

- Regular Review and Feedback Loop: Set up regular intervals to review and refine your framework. Incorporate feedback and lessons learned from past investment decisions to improve the process.

Considerations for an Effective Framework

- Balance and Relevance: Ensure a balanced approach, where no single type of analysis overshadows the others. The relevance of each analysis type may vary depending on the specific investment scenario.

- Adaptability: The framework should be adaptable to different market conditions and investment scenarios.

- Data Management: Efficiently managing and synthesizing data from various sources is key to preventing information overload.

Developing a framework for “Combining Fundamental Analysis, Macro Analysis, Technical Analysis, and On-Chain Analysis” is a dynamic and ongoing process that requires careful consideration of various market factors and data sources. This structured approach helps in making well-informed investment decisions backed by a comprehensive analysis.

Skill Set and Learning Curve

Navigating the complex terrain of “Combining Fundamental Analysis, Macro Analysis, Technical Analysis, and On-Chain Analysis” requires a specific skill set and an understanding of the learning curve involved. This multidisciplinary approach demands not just proficiency in individual analysis methods, but also the ability to integrate these methods for a comprehensive view of the markets.

Essential Skills for Combined Analysis

- Analytical Skills: The ability to analyze financial statements, market trends, economic indicators, and blockchain data is fundamental. This includes interpreting charts, understanding financial ratios, and analyzing economic reports.

- Critical Thinking: Being able to critically assess and synthesize information from different analysis types is crucial. This involves evaluating the relevance and impact of data on investment decisions.

- Adaptability and Flexibility: Markets are dynamic. The ability to adapt strategies based on evolving market conditions and data is essential.

- Technical Proficiency: Familiarity with analysis tools and software is important. This includes understanding how to use charting tools, financial databases, and blockchain explorers.

Navigating the Learning Curve

- Start with Basics: Begin by learning the basics of each analysis type. There are numerous online resources, courses, and books available for this purpose.

- Practical Application: Apply your knowledge in practical scenarios. Start with paper trading or small investments to test your analysis without significant risk.

- Continuous Learning: The financial world is constantly evolving. Stay updated with market trends, economic developments, and technological advancements in blockchain and analysis tools.

- Seek Mentorship and Community Support: Engaging with a community of investors or seeking mentorship can provide practical insights and guidance.

Mastering “Combining Fundamental Analysis, Macro Analysis, Technical Analysis, and On-Chain Analysis” is a journey that involves developing a diverse set of skills and continuously adapting to new information and market conditions. The learning curve can be steep, but with dedication and the right approach, it is surmountable.

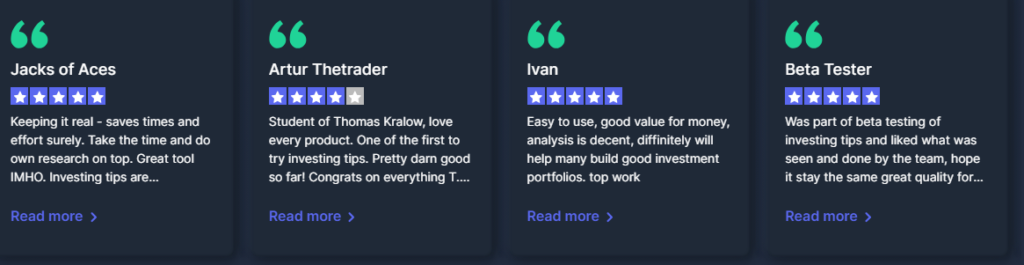

Case Studies and Success Stories

See what people has to say about his investing tips:

Challenges and Limitations

While “Combining Fundamental Analysis, Macro Analysis, Technical Analysis, and On-Chain Analysis” offers a comprehensive approach to market analysis, it also presents certain challenges and limitations. Acknowledging and understanding these challenges is crucial for effectively applying this combined analysis strategy.

Data Overload and Complexity

- Issue: Integrating multiple forms of analysis can lead to an overwhelming amount of data, making it difficult to discern what information is most relevant and actionable.

- Mitigation: Develop a systematic approach to filter and prioritize data. Use advanced tools and software to manage and interpret data efficiently.

Conflicting Signals

- Issue: Different analysis methods can sometimes provide conflicting signals. For instance, fundamental analysis might suggest a stock is undervalued, while technical analysis indicates a downward trend.

- Mitigation: Establish a clear framework for decision-making that outlines how to weigh and resolve conflicting signals. Experience and judgment play a key role in navigating these conflicts.

Time and Resource Investment

- Issue: Mastering and effectively combining these analysis methods requires significant time and resources. It can be particularly challenging for individual investors without access to extensive research teams and tools.

- Mitigation: Focus on building expertise gradually. Leverage online resources, training, and community knowledge. Consider using integrated analysis platforms that consolidate various data sources.

Rapid Market Changes

- Issue: Financial markets can change rapidly, and keeping up with these changes using a multi-dimensional analysis approach can be challenging.

- Mitigation: Implement regular reviews of your analysis framework. Stay informed about market and technological developments that could impact your analysis.

Cryptocurrency Market Specificity

- Issue: On-Chain Analysis is specific to cryptocurrencies and may not seamlessly integrate with traditional analysis methods used for other asset classes.

- Mitigation: Treat On-Chain Analysis as a complementary tool, particularly when dealing with investments that straddle both traditional and cryptocurrency markets.

While the approach of “Combining Fundamental Analysis, Macro Analysis, Technical Analysis, and On-Chain Analysis” is powerful, it comes with its set of challenges and limitations. Recognizing and addressing these issues is key to leveraging this comprehensive analysis strategy effectively.

Future of Combined Analysis in Investment

As the financial landscape continues to evolve, the approach of “Combining Fundamental Analysis, Macro Analysis, Technical Analysis, and On-Chain Analysis” is likely to play an increasingly significant role in investment strategy. This multi-dimensional analysis approach aligns well with the growing complexity and interconnections of global financial markets.

Integration with Emerging Technologies

- Trend: The integration of AI and machine learning in financial analysis is set to enhance the effectiveness of combined analysis methods. These technologies can process large datasets more efficiently, identify patterns, and even predict market trends with greater accuracy.

- Impact: This integration will likely make it easier to manage the complexities and data overload associated with combining different analysis types, leading to more sophisticated and informed investment decisions.

Increased Accessibility and Democratization

- Trend: Advanced analysis tools are becoming more accessible to individual investors, democratizing the process of combined analysis that was once the domain of institutional investors.

- Impact: This accessibility will empower a broader range of investors to make data-driven decisions, potentially leveling the playing field in financial markets.

Expansion in Cryptocurrency Markets

- Trend: As the cryptocurrency market matures, the role of On-Chain Analysis will expand. It will become more integrated with traditional analysis methods as digital assets become more mainstream.

- Impact: Investors will have a more comprehensive toolkit for analyzing and investing in cryptocurrencies alongside traditional assets.

Enhanced Global Market Analysis

- Trend: Globalization and digital connectivity are making it imperative to consider a global perspective in investment analysis.

- Impact: Combining various analysis types will be crucial for understanding and navigating the interconnected global financial landscape, especially in emerging and frontier markets.

Adaptation to Regulatory Changes

- Trend: Ongoing and future regulatory changes in financial markets will likely influence how different analysis methods are applied and combined.

- Impact: Investors will need to adapt their combined analysis frameworks to stay compliant and effective under changing regulatory landscapes.

The future of “Combining Fundamental Analysis, Macro Analysis, Technical Analysis, and On-Chain Analysis” in investment is poised for significant evolution, driven by technological advancements, increased accessibility, and the growing complexity of global financial markets.

Conclusion

In the ever-evolving world of investment, the approach of “Combining Fundamental Analysis, Macro Analysis, Technical Analysis, and On-Chain Analysis” stands as a beacon of comprehensive market understanding. This multi-faceted strategy not only enriches investment decisions but also paves the way for navigating the complexities of modern financial markets with greater confidence and insight.

The integration of these diverse analysis methods offers a unique advantage – the ability to view the investment landscape through multiple lenses. Fundamental Analysis provides a solid ground of financial health, Macro Analysis offers a broader economic perspective, Technical Analysis brings the precision of market timing, and On-Chain Analysis opens up the dynamic world of cryptocurrency. When harmonized, these methods deliver a depth of understanding that is much more than the sum of its parts.

However, as we’ve explored, this approach is not without its challenges. It demands a commitment to continuous learning, adaptability, and the thoughtful integration of varied data sources. The journey through this complex terrain requires diligence, critical thinking, and an openness to evolving technologies and market trends.

Looking ahead, the future of investment analysis is bright and promising. With advancements in technology, particularly AI and machine learning, and the increasing accessibility of sophisticated analysis tools, the combined approach will become more refined and potent. This evolution will empower both seasoned investors and newcomers alike, offering new opportunities for success in the financial markets.

In conclusion, “Combining Fundamental Analysis, Macro Analysis, Technical Analysis, and On-Chain Analysis” is more than a strategy; it’s a comprehensive mindset that equips investors to navigate the multifaceted nature of today’s investment world. Embracing this approach means being better prepared for the uncertainties of the market and poised to capitalize on the opportunities that come with a deeper, more nuanced understanding of the financial world.