Introduction to Yield Farming

Welcome to the fascinating world of Yield Farming, a cornerstone of the ever-evolving decentralized finance (DeFi) landscape. This blog post is your comprehensive guide to understanding the ins and outs of yield farming – from its fundamental mechanisms and key components to the strategies, risks, and future prospects that shape this dynamic financial practice.

Whether you’re a seasoned investor, a curious newcomer, or simply looking to expand your knowledge about this cutting-edge aspect of DeFi, this post will provide you with valuable insights and essential information. We’ll dive into the technicalities, explore the risks and rewards, and uncover the strategies that can help you navigate the complexities of yield farming effectively.

Join us as we explore the intricate and exciting world of yield farming, where technology and finance converge to offer new opportunities in the digital age.

Table of Contents

How Yield Farming Works

Yield Farming, a cornerstone concept in the decentralized finance (DeFi) space, represents an innovative way to generate rewards with cryptocurrency holdings. Unlike traditional banking, where interest is earned on savings, yield farming involves leveraging the power of blockchain technology for potentially higher returns.

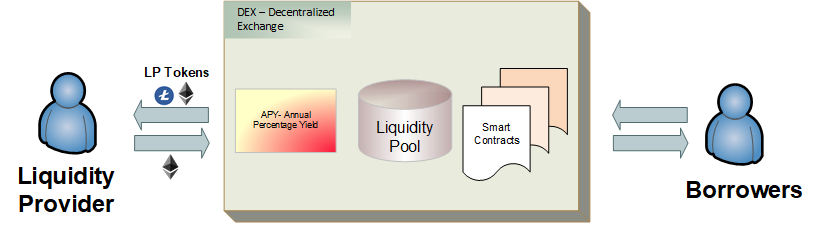

Understanding the Mechanism

At its core, yield farming works by users providing liquidity to a liquidity pool, which is essentially a smart contract containing funds. These pools power a marketplace where users can lend, borrow, or exchange tokens. By providing liquidity, users get LP (Liquidity Provider) tokens, representing their stake in the pool.

Role of Smart Contracts

Smart contracts are the backbone of yield farming. They autonomously execute predefined rules and conditions, ensuring transactions within the DeFi ecosystem are transparent and trustless. Yield farmers need to interact with these smart contracts to deposit their assets and to manage their investments.

Liquidity Pools: The Fuel of Yield Farming

Liquidity pools are crucial for the functionality of decentralized exchanges (DEXs). They allow for asset trading without the need for a traditional buyer-seller market. When yield farmers deposit their cryptocurrencies into these pools, they provide the necessary liquidity for other users to trade, borrow, or lend assets.

Earning Returns

In return for their services, liquidity providers earn rewards. These rewards come from fees generated by the underlying DeFi platform or from interest paid by borrowers. The returns are usually denoted as a percentage yield, calculated annually, known as the Annual Percentage Yield (APY).

The image below display the process of earning returns from yield farming, generated by APY and interest from borrowers:.

Dynamic and Complex

Yield farming is dynamic, with constantly changing rewards. Factors like liquidity in a pool, the platform’s fee structure, and the underlying smart contract’s rules can significantly impact potential yields. This complexity requires farmers to stay informed and agile in their strategies.

Yield farming, while potentially lucrative, is complex and involves significant risks. It’s crucial for anyone interested in yield farming to understand how it works, the risks involved, and the strategies to mitigate them. Despite its challenges, yield farming remains a key attraction in the DeFi space, offering a new paradigm of earning investment returns on digital assets.

Key Components of Yield Farming

Yield Farming, a significant practice within decentralized finance (DeFi), is built upon several key components that work together to create its unique ecosystem. Understanding these components is essential for anyone looking to participate in yield farming.

Liquidity Providers (LPs)

Liquidity Providers are at the heart of yield farming. They are individuals or entities that contribute their assets to liquidity pools. In return, they receive LP tokens, which represent their share of the pool. These tokens can be used to reclaim their share, plus any fees earned from the liquidity they provided.

Yield Farming Protocols

These are the platforms or projects that run yield farming operations. Examples include Compound, Aave, and Yearn.finance. Each protocol has its unique rules and reward structures. They use smart contracts to automate the processes involved in yield farming, such as distributing rewards.

Decentralized Exchanges (DEXs)

DEXs like Uniswap and SushiSwap are integral to yield farming. They provide the platform for liquidity pools and facilitate token swaps without the need for an intermediary. Liquidity providers contribute to these exchanges, enabling smoother trading experiences.

Governance Tokens

These are tokens issued by DeFi platforms that give holders governance rights, such as voting on changes to the protocol. Often, these tokens are also a reward for liquidity providers, aligning their interests with the long-term success of the protocol.

Each component of yield farming plays a vital role in its functioning and success. From liquidity providers who supply the assets, to the protocols and exchanges that organize and facilitate the farming, down to the governance tokens that shape the future of the platforms – all are crucial in the intricate world of yield farming. Understanding these components gives a clearer picture of how yield farming operates and the various dynamics involved.

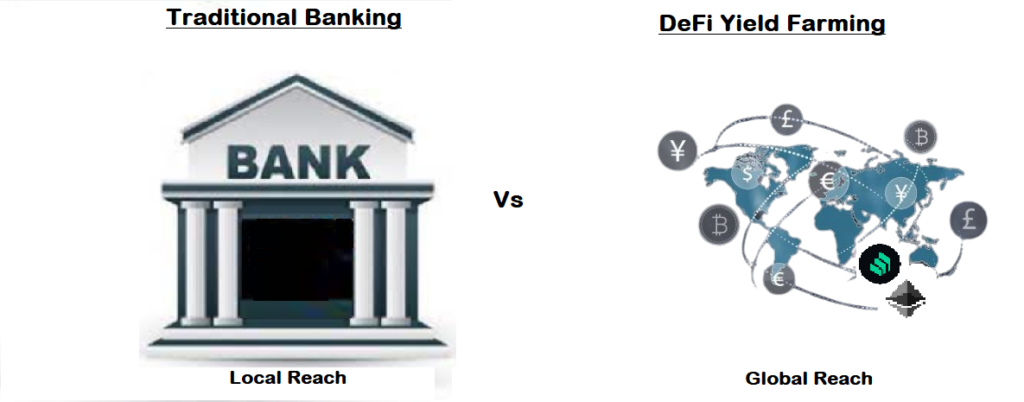

Yield Farming vs. Traditional Banking

In the financial world, yield farming represents a significant shift from traditional banking practices. Understanding the differences between these two can offer valuable insights into the evolving landscape of finance.

Return on Investment (ROI)

One of the most striking differences is the potential ROI. Yield farming often offers significantly higher returns compared to traditional banking savings accounts or even investment products. This is due to the higher risks and the innovative use of decentralized finance technologies.

Risks and Rewards

Yield farming carries with it a unique set of risks, such as smart contract vulnerabilities, impermanent loss, and market volatility. Traditional banking, on the other hand, offers a more stable and predictable investment environment, often backed by governmental insurance schemes like the FDIC in the USA.

Accessibility and Inclusivity

Another key difference is accessibility. Yield farming is accessible to anyone with an internet connection and a digital wallet, breaking down many of the barriers to entry present in traditional banking. However, it requires a certain level of technical knowledge and comfort with digital technologies.

The image below is the representation of the global reach of yield farming compared to the more localized nature of traditional banking:

While yield farming and traditional banking both offer avenues for earning interest on assets, they cater to different types of investors and come with their own sets of advantages and challenges. Yield farming is a cutting-edge, high-reward sector, attractive for those comfortable with its risks and technological demands. In contrast, traditional banking offers a more stable and familiar financial environment, preferred by those seeking security and predictability.

Understanding these differences is crucial for making informed decisions in the diverse world of finance, where both traditional banking and innovative practices like yield farming have their unique roles to play.

Popular Yield Farming Platforms

In the realm of decentralized finance (DeFi), various platforms have emerged as popular choices for yield farming. These platforms are known for their innovative features, user-friendly interfaces, and potentially high returns.

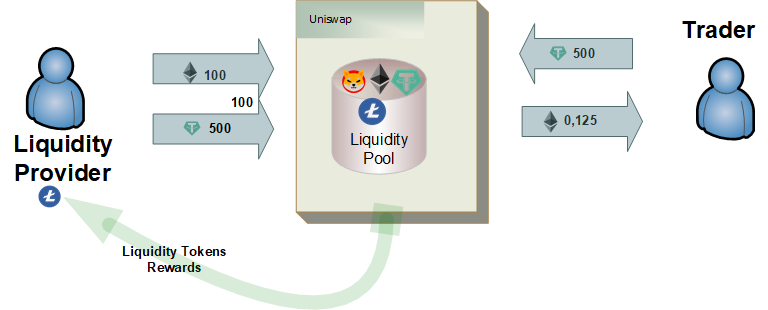

Uniswap

Uniswap is a leading decentralized exchange (DEX) in the DeFi space, widely recognized for its role in facilitating yield farming. It operates on an automated liquidity protocol, allowing users to swap various cryptocurrencies without the need for a traditional market. Yield farmers can provide liquidity to Uniswap’s pools and earn a portion of the transaction fees as rewards.

How Uniswap works basically, see diagram below:

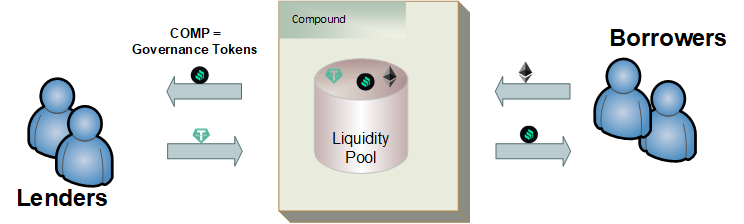

Compound

Compound is another major player in the yield farming sector. It functions as a decentralized lending platform where users can lend or borrow different cryptocurrencies. Lenders earn interest on their deposits, and the interest rates are determined algorithmically based on supply and demand. Compound also distributes its COMP governance token to users, adding an extra layer of incentive.

See diagram below – COMP is the governance Token

Aave

Aave stands out for its unique features like flash loans and a wide range of supported cryptocurrencies. It operates similarly to Compound, offering decentralized lending and borrowing services. Aave’s interest rates are also algorithmically determined, and users can earn rewards by providing liquidity to the platform.

See below Aave interface:

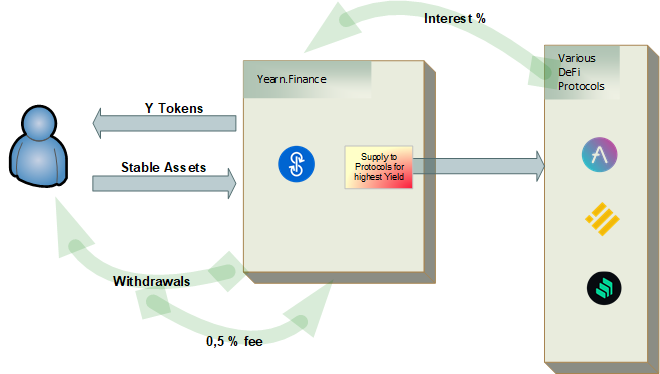

Yearn.finance

Yearn.finance is renowned for its strategy of optimizing yield farming returns. It automatically moves users’ deposited funds between different DeFi protocols to maximize earnings. The platform’s YFI token has also garnered significant attention in the crypto community.

Below image illustrate how Yearn.finance optimizes users’ funds across various DeFi protocols:

These popular yield farming platforms highlight the diversity and innovation within the DeFi space. Each platform has its unique mechanisms and reward structures, catering to different preferences and strategies in yield farming. As the sector continues to evolve, these platforms are likely to introduce even more features, solidifying their positions as key destinations for yield farming enthusiasts.

Understanding Yield Farming Returns

Yield farming is often highlighted for its potential to generate substantial returns on investment. However, understanding how these returns are calculated and what factors influence them is crucial for anyone involved in this space.

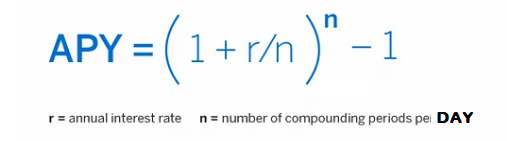

Annual Percentage Yield (APY)

The most common metric used to understand yield farming returns is the Annual Percentage Yield (APY). APY reflects the real rate of return that can be expected over a year, taking into account the effect of compounding interest. This is where yield farming can differ significantly from traditional finance, as the compounding can occur more frequently, sometimes even multiple times a day.

Factors Affecting Yields

Several factors can affect the returns from yield farming:

- Liquidity in the Pool: The amount of liquidity in a pool can impact the returns. Higher liquidity generally means lower returns as the rewards are distributed among more participants.

- Platform Fees: Different DeFi platforms have varying fee structures, which can affect the overall yield.

- Price Fluctuations: The value of the deposited assets can fluctuate, affecting the overall returns in terms of the base currency.

- Farming Strategies: Strategies like staking in different pools or leveraging can impact the returns, either positively or negatively.

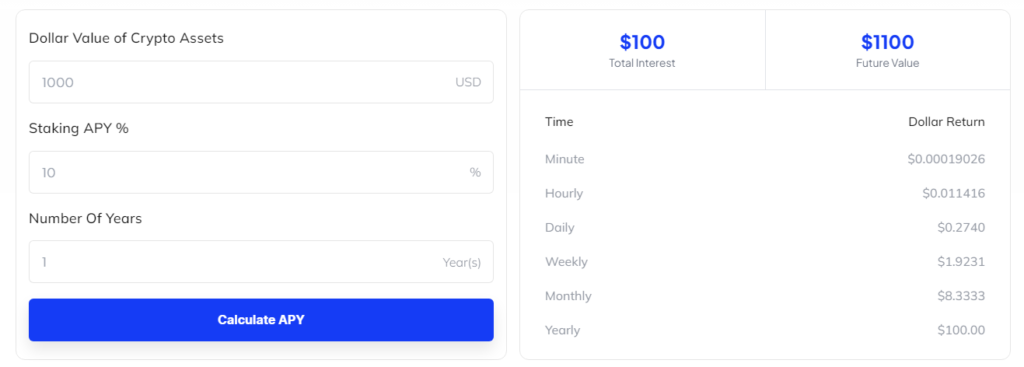

Yield Farming Calculations

Calculating yield farming returns can be complex, as it involves considering the fluctuating APY, compound frequency, and the changing value of the underlying assets. There are online calculators and tools designed to help with these calculations, providing yield farmers with a clearer picture of their potential earnings.

See below a screenshot of a yield farming calculator tool:

Understanding yield farming returns requires a grasp of APY, awareness of the factors that can influence these returns, and the ability to navigate the calculations involved. While the potential for high returns is a significant attraction in yield farming, it’s crucial to approach with an understanding of the inherent complexities and risks.

Risks and Challenges in Yield Farming

While yield farming offers the potential for high returns, it’s important to understand the associated risks and challenges. These factors are crucial for anyone looking to get involved in yield farming to consider, ensuring informed decision-making.

Smart Contract Risks

One of the primary risks in yield farming stems from the reliance on smart contracts. These are automated contracts that execute when certain conditions are met. However, they can contain vulnerabilities or bugs. If a smart contract is exploited, it can lead to significant losses for users who have staked their assets in it.

Impermanent Loss

Impermanent loss is a risk specific to providing liquidity in an Automated Market Maker (AMM) system. It occurs when the price of your deposited assets changes compared to when you deposited them. The greater the change, the more significant the impermanent loss. This is particularly relevant in volatile markets.

Market Volatility

Cryptocurrency markets are known for their high volatility. This can impact yield farming, as the value of the rewards may fluctuate greatly. High volatility can lead to high rewards but also significant losses.

Liquidity Issues

Liquidity can be a double-edged sword in yield farming. While a lack of liquidity can lead to higher rewards for those providing it, it can also mean that it becomes challenging to withdraw your assets without impacting the market price, potentially leading to losses.

Yield farming, while an innovative and potentially lucrative practice within DeFi, comes with its set of risks and challenges. Understanding these risks, including smart contract vulnerabilities, impermanent loss, market volatility, and liquidity issues, is essential for anyone participating in yield farming. Adequate knowledge and risk management are key to navigating this dynamic yet complex landscape.

Strategies for Effective Yield Farming

To navigate the dynamic and complex world of yield farming successfully, adopting effective strategies is essential. These strategies can help in maximizing returns while minimizing risks.

Diversification

Just like in traditional investing, diversification is key in yield farming. It involves spreading your investments across various platforms and liquidity pools. This approach can help mitigate the risks associated with any single platform or asset.

Assessing Risk vs. Reward

Understanding the risk-reward ratio of different yield farming opportunities is crucial. Higher returns usually come with higher risks, such as impermanent loss or market volatility. Yield farmers should evaluate these factors to find opportunities that align with their risk tolerance.

Long-term vs. Short-term Strategies

Yield farmers should consider their investment horizon – whether they are in it for the long haul or looking for short-term gains. Long-term strategies might involve staking in platforms with a stable history, while short-term strategies could focus on taking advantage of high APY offers that might not last long.

Staying Informed and Agile

The DeFi space and yield farming landscape are constantly evolving. Staying informed about the latest developments, protocol updates, and market trends is crucial for yield farming effectively. This knowledge allows for agile decision-making and strategy adjustments.

Using Automation Tools

Automation tools can be a boon in yield farming, helping to manage investments and rebalance portfolios based on changing market conditions. These tools can also aid in executing more complex strategies, like yield farming across multiple platforms or layering strategies.

Effective yield farming requires a blend of strategies, from diversification and risk assessment to staying informed and using the right tools. By applying these strategies, yield farmers can navigate the DeFi space more confidently, aiming for optimal returns while keeping risks in check.

Future of Yield Farming

As a rapidly evolving component of decentralized finance (DeFi), the future of yield farming holds vast potential and possibilities. Understanding the trends and directions in which it may develop is crucial for participants and observers alike.

Trends and Predictions

Yield farming is expected to continue growing, both in terms of popularity and technological advancement. We may see more sophisticated strategies and protocols emerging, as well as increased integration with traditional finance. The introduction of new blockchain platforms might also diversify the yield farming landscape, offering new opportunities and challenges.

Impact of Regulations

As with any growing financial sector, regulation will play a significant role in shaping the future of yield farming. Governments and financial bodies around the world are beginning to pay more attention to DeFi, and their decisions will influence how yield farming evolves, especially in terms of accessibility, security, and mainstream adoption.

Potential Technological Advancements

Blockchain technology, which underpins yield farming, is continually advancing. We can expect enhancements in smart contract functionalities, security features, and transaction efficiency. These advancements could make yield farming more accessible, profitable, and secure for a broader range of participants.

Challenges and Opportunities

As yield farming matures, it will likely face new challenges such as scalability, interoperability between different blockchain platforms, and more sophisticated forms of cyber threats. Addressing these challenges effectively will be key to sustaining the growth and health of the yield farming ecosystem.

The future of yield farming appears promising but is marked by both opportunities and challenges. It’s a space that requires constant learning, adaptation, and an understanding of both the technological and regulatory landscape. For those willing to stay informed and engaged, yield farming could remain a compelling aspect of the evolving world of finance.

Yield Farming and the DeFi Ecosystem

Yield farming is not just a standalone practice; it’s an integral part of the broader decentralized finance (DeFi) ecosystem. Understanding this relationship is key to comprehending the full scope and potential of yield farming.

Integration with Other DeFi Components

Yield farming works in tandem with various other components of DeFi, such as decentralized exchanges (DEXs), lending platforms, and stable-coins. For instance, the liquidity provided in yield farming is essential for the smooth operation of DEXs. Similarly, lending platforms use these pools to facilitate loans, creating a synergistic relationship.

Synergies and Dependencies

The success of yield farming is often linked to the overall health and growth of the DeFi space. For example, innovations in DeFi can lead to more efficient yield farming strategies, while the popularity of yield farming can drive more users and funds into the DeFi ecosystem, benefiting all its components.

Challenges in Integration

While the integration of yield farming with the DeFi ecosystem offers many benefits, it also brings challenges. Issues like network congestion, high transaction fees, and the complexity of interacting with multiple protocols can be daunting for users. These challenges require ongoing technological improvements and user education.

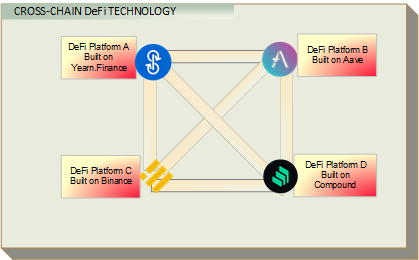

Future Collaborations

As the DeFi space continues to evolve, we can expect deeper and more innovative collaborations between yield farming and other DeFi sectors. This could include cross-chain yield farming, enhanced liquidity solutions, and more user-friendly interfaces, further strengthening the ecosystem.

See conceptual image below showcasing futuristic DeFi collaborations:

Yield farming is a vital cog in the DeFi machine. Its integration with various elements of the DeFi ecosystem not only enhances its own functionality but also contributes to the growth and innovation of the entire DeFi space. Understanding this interplay is crucial for anyone looking to dive into yield farming or DeFi in general.

Security Measures in Yield Farming

Security is a paramount concern in yield farming, given its digital and decentralized nature. Ensuring the safety of funds and operations in the yield farming space involves understanding and implementing various security measures.

Understanding Smart Contract Risks

Since yield farming operations are based on smart contracts, it’s crucial to understand the risks associated with them. This includes potential bugs or vulnerabilities. Yield farmers should prioritize platforms that have undergone thorough smart contract audits by reputable firms.

Choosing Reputable Platforms

One of the primary security measures in yield farming is selecting platforms known for their security and stability. This often means choosing platforms with a strong track record, active community, and transparent practices.

Using Secure Wallets

The choice of wallet can significantly impact the security of your yield farming activities. Using wallets that offer robust security features, such as hardware wallets or wallets with multi-signature capabilities, can provide an additional layer of safety.

Practicing Safe Yield Farming Habits

Secure yield farming also involves individual practices, such as keeping software updated, using strong, unique passwords, and being vigilant against phishing scams. Regularly checking transactions and balances can help in early detection of any irregularities.

Staying Informed and Educated

The DeFi space, including yield farming, is constantly evolving, with new threats and security measures emerging regularly. Staying informed about the latest security trends and education is vital for maintaining the safety of your investments.

Security in yield farming is multi-faceted, involving both the choice of platforms and personal security habits. By understanding and implementing these measures, yield farmers can better protect their assets and participate in the DeFi space with greater confidence.

Tools and Resources for Yield Farming

To navigate the world of yield farming effectively, it’s essential to have the right tools and resources at your disposal. These can help in decision-making, strategy implementation, and risk management.

Yield Farming Calculators

Yield farming calculators are invaluable for estimating potential returns. They take into account factors like APY, staking amounts, and farming duration. This can help farmers make informed decisions about where and how much to invest.

DeFi Dashboards and Analytics Platforms

Platforms like DeFi Pulse, Ape Board, and Zapper provide comprehensive insights into the DeFi market, including yield farming opportunities. They offer real-time data on liquidity pools, APYs, and other vital metrics, allowing farmers to track and manage their investments efficiently.

Automated Yield Farming Bots

For those who prefer a more hands-off approach, automated yield farming bots can be a game-changer. These bots can automatically move assets to the most profitable pools, though they require a good understanding of both the risks and strategies involved in yield farming.

Educational Resources and Community Forums

Websites, blogs, and forums dedicated to yield farming and DeFi are crucial for staying updated and learning from the community. Resources like the DeFi Prime and various Reddit communities offer a wealth of information, from basic guides to advanced strategies and market analysis.

Wallets and Security Tools

Secure wallets, both hardware and software, are crucial for safeguarding your assets in yield farming. Additionally, tools that offer additional security layers, like multi-factor authentication, are highly recommended.

Having the right set of tools and resources is vital for anyone looking to engage in yield farming. From calculators and analytics platforms to educational forums and security tools, these resources can significantly enhance the yield farming experience, making it more efficient, informed, and secure.

Expert Opinions and Analysis

Gaining insights from experts and analyzing current trends are crucial for understanding the complex world of yield farming. Expert opinions can provide a deeper perspective on the strategies, risks, and future potential of this innovative financial practice.

Insights from Industry Leaders

Prominent figures in the DeFi and blockchain space often share their insights on yield farming. They discuss topics ranging from emerging trends to risk management strategies. Listening to podcasts, reading interviews, or attending webinars featuring these experts can provide valuable knowledge and foresight.

Current Market Analysis

Market analysts provide regular updates on the state of yield farming markets. They analyze patterns, identify emerging opportunities, and highlight potential risks. Following reputable financial news websites, DeFi analysis blogs, and social media channels of market analysts can keep yield farmers informed about current and future market conditions.

Impact of Global Economic Trends

Experts also analyze how global economic trends affect yield farming. This includes the influence of regulatory changes, technological advancements, and macroeconomic factors. Understanding these broader trends can help in making more informed yield farming decisions.

Technological Advancements and Predictions

Tech experts in blockchain and cryptocurrency often make predictions about how technological advancements could shape the future of yield farming. Staying abreast of these predictions can provide insights into potential new strategies and tools in the yield farming space.

Risk Assessment and Mitigation

Risk assessment is a key topic among experts. They provide analyses on various types of risks associated with yield farming, such as liquidity risks, smart contract vulnerabilities, and market volatility, offering advice on how to mitigate these risks effectively.

Expert opinions and analysis are invaluable for anyone involved in yield farming. They offer a blend of practical advice, strategic insights, and foresight into future trends and challenges, helping yield farmers navigate the DeFi space more effectively.

Conclusion and Future Outlook

Yield farming, a pivotal element in the decentralized finance (DeFi) landscape, presents a unique blend of opportunities and challenges. As we have explored throughout this blog post, yield farming is not only about high potential returns but also involves understanding various components, strategies, risks, and the ever-evolving nature of the DeFi ecosystem.

Key Takeaways

- Dynamic Nature: Yield farming is dynamic and requires continuous learning and adaptation to new tools, platforms, and market conditions.

- Risk Management: Understanding and managing risks are crucial. This involves not just diversification of investments but also staying updated with security practices and market trends.

- Community and Education: Engaging with the yield farming community and utilizing educational resources enhances one’s understanding and ability to navigate the DeFi space effectively.

- Technological Evolution: Keeping an eye on technological advancements in blockchain and DeFi can provide insights into new yield farming opportunities and strategies.

- Regulatory Landscape: Being aware of the evolving regulatory landscape is important for sustainable and compliant participation in yield farming.

Looking Ahead

The world of yield farming is poised for continued growth and innovation. With the increasing integration of DeFi with traditional financial systems and the ongoing technological advancements, yield farming is likely to become more accessible, diversified, and secure.

For enthusiasts, investors, and the curious, the journey into yield farming is not without its hurdles, but it offers a fascinating glimpse into the future of finance. As with any financial endeavor, the key lies in balancing the allure of high returns with a sound understanding of the risks and strategies involved.

Yield farming represents not just a financial opportunity but a step towards a more open, inclusive, and decentralized financial system. As this exciting space evolves, it invites us to learn, adapt, and grow with it.