Introduction to Uniswap

Uniswap has emerged as a revolutionary force in the world of decentralized finance (DeFi), redefining how we interact with digital assets and liquidity. In this comprehensive guide, we delve into the various facets of Uniswap, exploring its functionality, impact, and the vibrant community that underpins its success. Whether you’re a crypto enthusiast, a seasoned investor, or new to the world of DeFi, this blog post will provide you with a thorough understanding of Uniswap and its pivotal role in shaping the future of finance. Join us as we navigate the ins and outs of this groundbreaking platform, uncovering the features that make Uniswap a cornerstone of the DeFi ecosystem.

Table of Contents

What is Uniswap?

Uniswap stands at the forefront of the decentralized finance (DeFi) revolution, offering a platform that redefines the way we think about trading in the cryptocurrency world. At its core, Uniswap is a decentralized exchange (DEX) that allows users to swap various cryptocurrencies without the need for a traditional intermediary or custodian.

The Basics

Unlike traditional exchanges, Uniswap operates on a model known as an automated liquidity protocol. This innovative approach enables trading directly between users (peer-to-peer) through liquidity pools. In these pools, tokens are locked in a smart contract, and users trade against these liquidity reserves. Prices are determined algorithmically based on supply and demand, diverging from the conventional order book model used by traditional exchanges.

The Advantage of Decentralization

One of the key advantages of Uniswap is its decentralized nature. It runs on the Ethereum blockchain, ensuring transparency and security for all transactions. This decentralization means that users don’t have to trust a central authority with their funds; instead, they retain full control over their assets at all times.

The Role of UNI Token

Uniswap has its native token, UNI, which is used for governance. Holders of UNI tokens can vote on proposals that affect the platform, embodying the ethos of decentralized governance.

User-Friendly Interface

Uniswap’s interface is designed with simplicity in mind, making it accessible for both beginners and experienced traders in the cryptocurrency space. Users can easily connect their Ethereum wallets, like MetaMask, to start trading.

How Uniswap Works

Understanding how Uniswap works is key to appreciating its innovation in the DeFi space. This platform has transformed the landscape of cryptocurrency trading with its unique approach to swapping tokens.

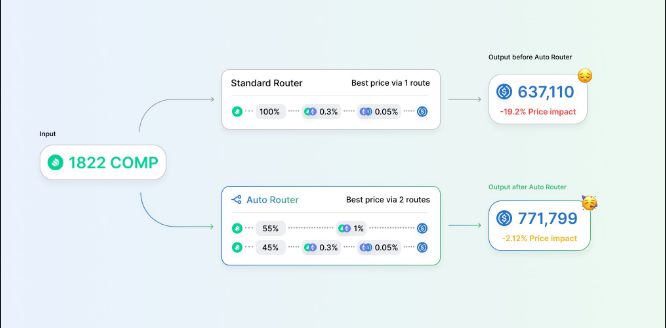

Automated Market Makers (AMMs)

At the heart of Uniswap’s operation is a concept known as Automated Market Makers (AMMs). Unlike traditional exchanges that use order books to match buyers and sellers, AMMs use a mathematical formula to price assets. This formula balances out trades based on the ratio of two tokens in a pool, ensuring liquidity at all times and setting prices according to supply and demand dynamics.

Liquidity Pools

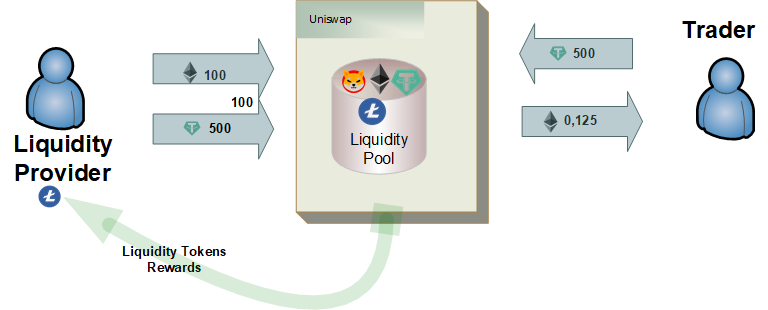

Central to Uniswap’s design are liquidity pools. These are essentially pools of tokens locked in a smart contract. Users, known as liquidity providers, add an equal value of two tokens to create a market. In return, they receive liquidity tokens, representing their share of the pool. These tokens can be redeemed for the underlying assets at any time.

Swapping Tokens

For users looking to swap tokens, Uniswap offers a straightforward process. When a user executes a swap, they add one token to the pool and receive another in return. The amounts are calculated based on the AMM algorithm, which adjusts the price according to the changing ratio of tokens in the pool.

Fee Structure

Uniswap charges a 0.3% fee for each trade, which is distributed to the liquidity providers proportional to their share in the pool. This incentivizes users to provide liquidity, as they earn fees from the trades that occur in their pool.

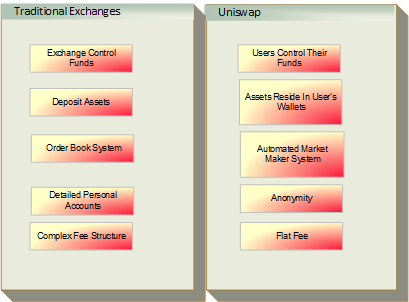

Uniswap vs. Traditional Exchanges

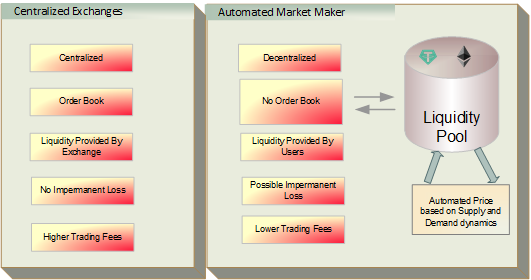

When it comes to trading cryptocurrencies, the choice between using Uniswap or a traditional exchange can significantly impact your trading experience. Understanding the differences is crucial for any investor in the crypto space.

Decentralization

The most striking difference between Uniswap and traditional exchanges is decentralization. Uniswap is a fully decentralized exchange, meaning it operates on a blockchain and doesn’t rely on any central authority. This structure enhances security, as there’s no single point of failure. Traditional exchanges, on the other hand, are centralized, requiring users to trust the exchange with their funds.

Custody of Assets

On Uniswap, users retain full control over their assets. They trade directly from their wallets without having to transfer tokens to the exchange. Traditional exchanges require users to deposit funds, which means giving up control of their assets to the exchange.

Trading Mechanism

Uniswap uses an Automated Market Maker (AMM) model, setting prices algorithmically and eliminating the need for order books. Traditional exchanges use an order book system where buy and sell orders are matched.

Anonymity and Accessibility

Uniswap offers greater anonymity since it doesn’t require user accounts or personal information. Traditional exchanges often require detailed verification processes, including personal identification, which can be a barrier for some users.

Fees and Liquidity

Uniswap’s fee structure is straightforward, with a flat fee for all trades. This fee is distributed to liquidity providers. Traditional exchanges may have more complex fee structures, including different rates for makers and takers, and withdrawal fees. Liquidity can vary on both platforms, but Uniswap’s liquidity is generally determined by the liquidity providers in each pool.

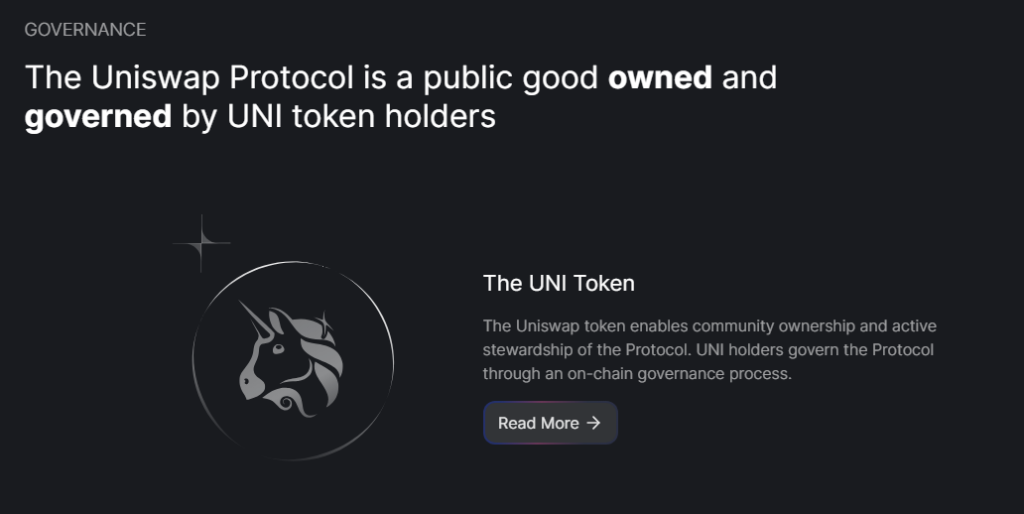

The UNI Token

The UNI token is an integral part of the Uniswap ecosystem, serving as more than just a digital asset. It’s a cornerstone of the platform’s governance and operational structure, making it a unique and valuable component of Uniswap.

Role and Utility

UNI is Uniswap’s native token, primarily used for governance. Token holders have the privilege of participating in key decision-making processes that shape the future of the Uniswap protocol. This includes voting on changes to the protocol, such as fee structures, upgrades, and even the distribution of community funds.

Tokenomics

The distribution of UNI tokens is designed to promote a decentralized and community-driven ecosystem. A significant portion of the tokens is allocated to Uniswap community members, while others are reserved for team members, advisors, and a governance treasury. This distribution ensures that the control of the platform is not concentrated in the hands of a few, but rather spread across its user base.

Governance

The UNI token empowers holders with a say in the governance process. By holding UNI, users can propose changes to the protocol, and vote on proposals made by others. This democratic approach to governance aligns with the ethos of decentralization that is central to the DeFi movement.

Using Uniswap: A Step-by-Step Guide

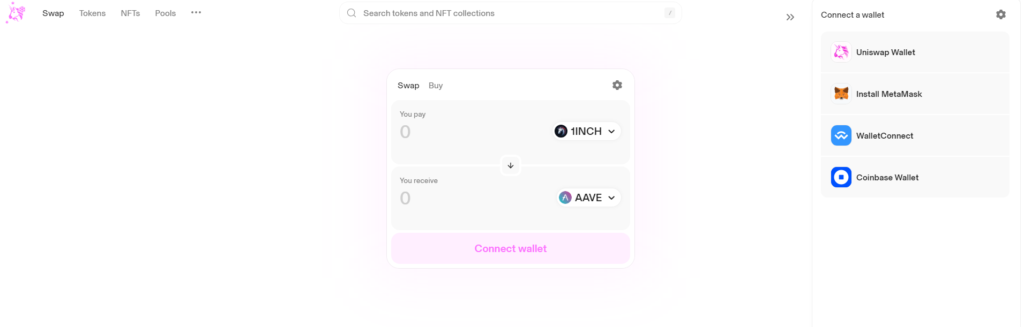

Uniswap’s user-friendly interface makes it accessible even for those new to the world of decentralized finance. Here’s a simple, step-by-step guide to using Uniswap for trading cryptocurrencies.

Step 1: Setting Up a Wallet

Before you start using Uniswap, you need an Ethereum wallet. Popular choices include MetaMask, Trust Wallet, or Coinbase Wallet. Ensure that your wallet is funded with some Ethereum (ETH), as you’ll need it to pay for transaction fees on the Ethereum network.

Step 2: Connecting Your Wallet to Uniswap

- Go to the Uniswap interface.

- Click on ‘Connect to a wallet’ on the top right corner.

- Select your wallet provider and follow the prompts to connect.

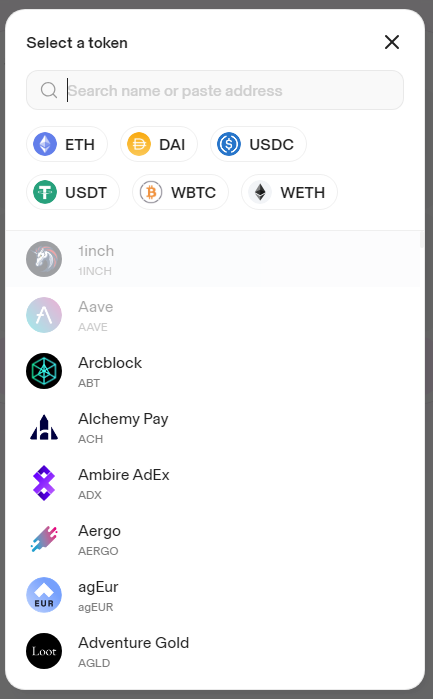

Step 3: Swapping Tokens

- Once connected, choose the token you want to swap from and the token you want to swap to.

- Enter the amount you wish to swap.

- Uniswap will show you the estimated amount of the token you will receive.

- Review the transaction details, including the gas fee.

- Confirm the transaction in your wallet.

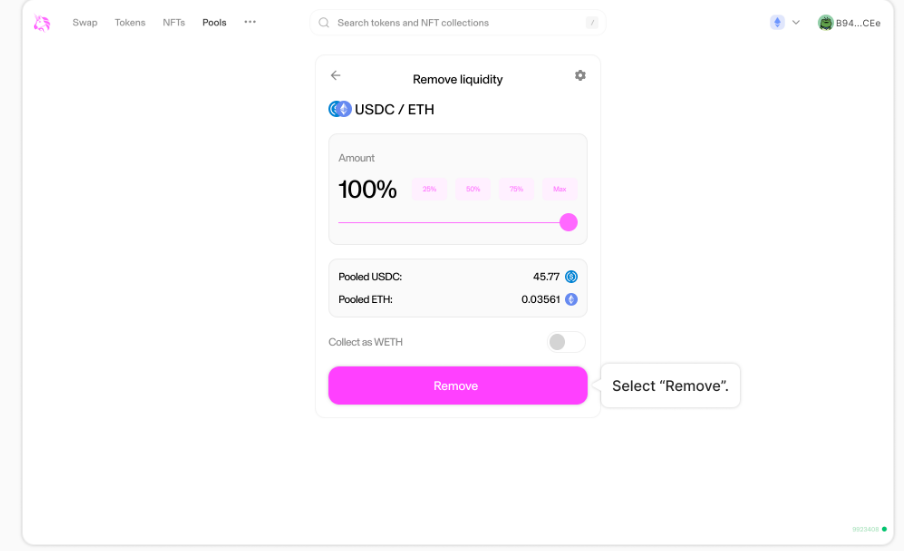

Step 4: Adding and Removing Liquidity (Optional)

- To provide liquidity, go to the ‘Pool’ tab and select ‘Add Liquidity.’

- Choose the pair of tokens you wish to add to the pool and the amount.

- Approve the transaction and confirm it in your wallet.

- To remove liquidity, go to the ‘Pool’ tab, find your pool, and select ‘Remove Liquidity.’

Step 5: Staking UNI Tokens (Optional)

- If you have UNI tokens, you can stake them in the governance module to earn rewards.

- Go to the ‘UNI’ tab and select ‘Stake UNI.’

- Choose the amount of UNI to stake and confirm the transaction.

Providing Liquidity on Uniswap

Providing liquidity on Uniswap is a crucial process that fuels the platform’s decentralized trading model. As a liquidity provider (LP), you contribute to the liquidity pools, enabling others to trade while earning transaction fees in return. Here’s how it works and what you need to consider.

What Does It Mean to Provide Liquidity?

When you provide liquidity on Uniswap, you’re adding equal values of two tokens to a liquidity pool. In return, you receive liquidity tokens, representing your share of the pool. These tokens can be redeemed for the underlying assets at any time, along with a portion of the trading fees accumulated in the pool.

Step-by-Step Guide to Providing Liquidity

- Choose a Liquidity Pool: Decide which pair of tokens you want to provide liquidity for. Popular pairs have higher trading volumes, potentially leading to more fee earnings but also to higher competition.

- Add Tokens to the Pool: Connect your wallet to Uniswap and select ‘Pool’ then ‘Add Liquidity.’ Choose your token pair and the amount you wish to add. You need to add both tokens in equal value.

- Confirm and Approve: Review the details, including your share of the pool and the current rates. Confirm and approve the transaction in your wallet.

Risks of Being a Liquidity Provider

While providing liquidity can be profitable, it comes with risks, particularly ‘impermanent loss.’ This occurs when the price of your deposited tokens changes compared to when you deposited them. The larger the change, the more significant the impermanent loss.

Withdrawing Liquidity

You can withdraw your liquidity at any time. When you do, you receive your share of the pool plus accrued fees, minus any impermanent loss. Simply go to the ‘Pool’ tab, find your pool, and select ‘Remove Liquidity.’

Yield Farming and Staking on Uniswap

Uniswap not only offers trading and liquidity provision but also opportunities for yield farming and staking, two popular ways to earn additional rewards in the DeFi space. Understanding how these work on Uniswap is key to maximizing your potential earnings.

What is Yield Farming?

Yield farming on Uniswap involves providing liquidity to a pool and then using the liquidity tokens to participate in other DeFi protocols or pools that offer additional rewards. This process often yields higher returns than traditional savings or investment methods, but it also comes with higher risks.

How to Participate in Yield Farming on Uniswap

- Provide Liquidity: First, you need to add liquidity to a Uniswap pool and receive liquidity tokens in return.

- Stake Your Liquidity Tokens: Stake these liquidity tokens in a compatible yield farming pool. This is often done on other platforms that integrate with Uniswap.

- Earn Rewards: You will earn rewards based on the amount and duration of your stake. These rewards can come in various forms, including additional tokens.

Staking on Uniswap

Staking on Uniswap involves locking up UNI tokens to participate in the governance of the protocol or in special staking pools. In return for staking your tokens, you receive rewards, which could include a share of transaction fees or other incentives.

How to Stake on Uniswap

- Acquire UNI Tokens: Purchase or acquire UNI tokens through trading on Uniswap or other exchanges.

- Stake Your UNI Tokens: On the Uniswap platform, navigate to the staking section and stake your UNI tokens.

- Earn Staking Rewards: You will earn rewards as long as your tokens are staked. The rewards vary depending on the staking pool and the amount staked.

Risks and Considerations

Both yield farming and staking come with risks, such as impermanent loss, price volatility, and smart contract risks. It’s important to understand these risks and do thorough research before participating.

Security Aspects of Uniswap

When engaging with any DeFi platform, understanding its security measures is crucial. Uniswap, as a leading decentralized exchange, incorporates several security features to protect its users and their assets. Let’s explore these aspects to gain confidence in using Uniswap securely.

Smart Contract Audits

Uniswap’s smart contracts are the backbone of its operations. To ensure their security, these contracts undergo rigorous audits conducted by reputable third-party firms. These audits help identify and rectify potential vulnerabilities, ensuring the integrity and safety of the platform.

Decentralized Nature

The decentralized nature of Uniswap itself is a significant security feature. Without a centralized authority, there’s no single point of failure. This structure reduces risks like server downtime and central points of attack, common in traditional centralized exchanges.

User-Controlled Funds

On Uniswap, users have full control over their funds at all times. Unlike centralized exchanges, where funds are held on the exchange, Uniswap users transact directly from their own wallets. This reduces the risk of losing assets due to the exchange being hacked or going offline.

Risks and How to Mitigate Them

While Uniswap has robust security features, it’s important to recognize that risks still exist, mainly related to smart contract vulnerabilities or user errors. Users can mitigate these risks by keeping their wallets secure, being cautious with transaction approvals, and staying informed about the latest security practices in DeFi.

Regular Updates and Community Oversight

Uniswap continually updates its protocol to address emerging security concerns and improve its features. The active Uniswap community also plays a vital role in overseeing and proposing enhancements, making the platform more resilient against threats.

Uniswap’s Governance Model

Uniswap’s governance model is a testament to its commitment to decentralization and community involvement. This model empowers UNI token holders to participate directly in the decision-making process, influencing the future direction of the platform.

Decentralized Governance

In Uniswap’s governance system, decisions are not made by a central authority but by the community of UNI token holders. Each holder has a say in the platform’s development, with the power to propose, vote on, and implement changes to the protocol.

The Role of UNI Tokens in Governance

UNI tokens are at the core of Uniswap’s governance. Holding these tokens grants the right to vote on proposals that affect the protocol. The more UNI tokens a user holds, the more voting power they possess.

Governance Process

- Proposal Submission: Any UNI token holder can submit a proposal, provided they meet a minimum token threshold.

- Voting: Once a proposal is submitted, it goes to a vote among UNI token holders. Votes are weighted based on the number of tokens held.

- Implementation: If a proposal receives enough votes, it is implemented into the Uniswap protocol.

Community Participation

Uniswap’s governance model encourages active participation from its community. This includes not just voting but also discussions, debates, and collaborative development of ideas.

Transparency

All proposals and voting activities are recorded on the blockchain, ensuring transparency and traceability. This openness fosters trust and accountability within the Uniswap community.

Uniswap’s Impact on the DeFi Ecosystem

Uniswap has emerged as a pivotal player in the decentralized finance (DeFi) ecosystem, revolutionizing how trading is conducted in the crypto space. Its impact extends far beyond its platform, influencing the broader DeFi landscape in several significant ways.

Facilitating Decentralized Trading

Uniswap has simplified the process of exchanging cryptocurrencies, enabling users to trade directly from their wallets without intermediaries. This innovation has set a new standard for decentralized trading, prioritizing ease of use, security, and accessibility.

Liquidity Pool Concept

The introduction of liquidity pools by Uniswap marked a fundamental shift in the DeFi ecosystem. These pools allow for more efficient and decentralized trading, resolving the liquidity issues faced by many early decentralized exchanges. This concept has been widely adopted and replicated across the DeFi space.

Governance and Tokenomics

Uniswap’s governance model and the UNI token have influenced how DeFi projects approach community-driven governance and token distribution. By empowering its users with governance rights, Uniswap has encouraged a more democratic and user-centric approach in the DeFi space.

Innovations and Trends

Uniswap has been at the forefront of several DeFi trends, including automated market making (AMM) and yield farming. These innovations have not only enhanced the functionality and attractiveness of DeFi but also spurred new developments and projects in the industry.

Case Studies and Success Stories

The success of Uniswap has inspired a myriad of other DeFi projects and protocols. Its model serves as a case study in successful decentralized platform design, influencing both new and existing projects in the DeFi sector.

Future Developments and Roadmap

As a trailblazer in the DeFi space, Uniswap continually evolves, with a roadmap aimed at enhancing its platform and further solidifying its position in the market. Understanding the future developments planned for Uniswap provides insight into the direction of not only the platform but also the broader DeFi ecosystem.

Scaling Solutions

To address the high gas fees and network congestion on the Ethereum blockchain, Uniswap is focusing on integrating scaling solutions. This includes potential deployment on Ethereum Layer 2 solutions or sidechains, which would significantly reduce transaction costs and increase speed.

Improved User Experience

Uniswap is committed to enhancing the user experience. This includes interface improvements for greater usability, more comprehensive analytics tools for traders, and possibly, features to facilitate cross-chain swaps directly within the platform.

Advanced Governance Features

Uniswap plans to expand its governance capabilities, allowing for more nuanced and sophisticated governance mechanisms. This could involve more layers of voting and proposal vetting to ensure that the community’s decisions are well-informed and beneficial to the platform’s growth.

Broader Token Support

As the DeFi space grows, Uniswap aims to support a wider range of tokens, including those from emerging blockchains. This expansion will not only increase trading opportunities but also strengthen Uniswap’s position as a comprehensive and inclusive DeFi platform.

Enhanced Security Measures

Continual enhancement of security measures is a key focus for Uniswap. This includes regular audits, upgrading smart contract protocols, and implementing additional safeguards to protect users’ funds against emerging threats.

Comparative Analysis with Other DeFi Platforms

Uniswap stands as a major player in the DeFi space, but it operates in a field with other noteworthy platforms. Understanding how Uniswap compares to these platforms can offer valuable insights into its strengths and potential areas for growth.

Trading Mechanism

Uniswap is renowned for its automated market maker (AMM) model, which sets it apart from platforms using traditional order book models. This AMM approach simplifies trading and provides constant liquidity, a significant advantage for users looking for ease and efficiency.

Fees and Gas Costs

Uniswap’s fee structure is straightforward, typically charging a flat rate of 0.3% per trade. However, being on the Ethereum network, users often face high gas fees. Some competitors operating on alternative blockchains or using Layer 2 solutions offer lower transaction costs.

User Experience

Uniswap’s interface is user-friendly and intuitive, making it accessible for newcomers. Other platforms might offer more advanced trading features, appealing to experienced traders, but this can sometimes come at the cost of user-friendliness.

Token Availability

While Uniswap offers a wide range of ERC-20 tokens, some DeFi platforms support a broader array of assets, including cross-chain tokens. This diversity can be an essential factor for users looking to trade a variety of cryptocurrencies.

Decentralization and Security

Uniswap’s fully decentralized nature and commitment to security through regular audits set high standards in the DeFi space. However, other platforms might offer different security features or levels of decentralization, which can be a deciding factor for users concerned with governance and control.

Community and Resources

The Uniswap community is a vibrant and integral part of its success. Alongside this engaged community, a wealth of resources is available to assist users in navigating and making the most of the Uniswap platform.

The Uniswap Community

The Uniswap community comprises developers, traders, liquidity providers, and enthusiasts passionate about decentralized finance. This community plays a crucial role in governance, proposal discussions, and the overall development of the platform.

- Forums and Discussion Boards: Platforms like Reddit, Discord, and Uniswap’s own governance forum are where community members discuss updates, share insights, and provide support to one another.

- Social Media Channels: Uniswap maintains an active presence on social media platforms like X (formerly known as Twitter) and Telegram, offering updates, educational content, and community engagement.

Educational Resources

For those new to Uniswap or DeFi, numerous resources are available to facilitate a deeper understanding of the platform and its functionalities.

- Uniswap Documentation: This comprehensive guide covers everything from basic concepts to more advanced topics, suitable for both beginners and experienced users.

- Tutorials and Guides: Various online platforms offer tutorials, how-to guides, and explainer videos to help users navigate Uniswap’s interface and features.

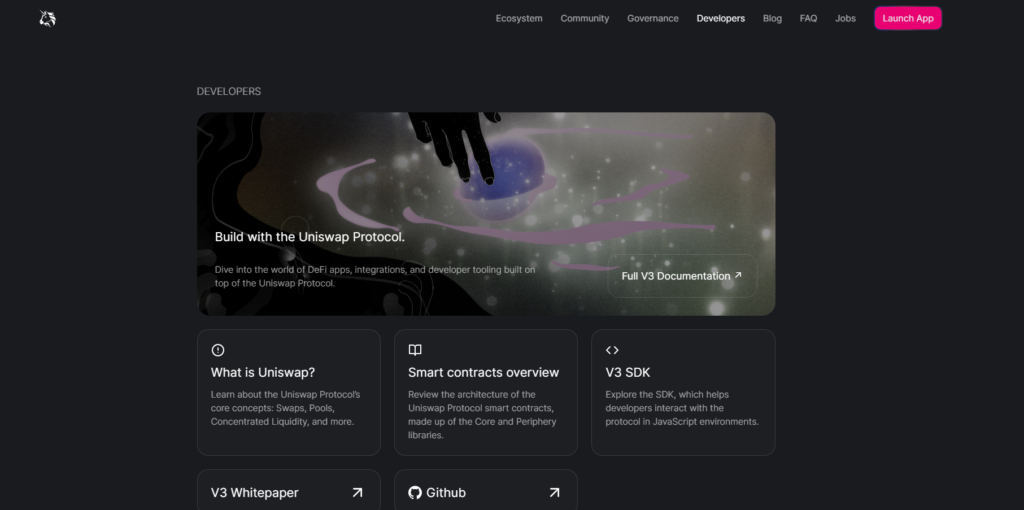

Developer Resources

Uniswap is open-source, inviting developers to contribute to its ecosystem. Resources for developers include:

- GitHub Repository: Access to Uniswap’s codebase for development and contribution.

- Developer Documentation: Detailed documentation is available to assist developers in understanding the protocol and building on top of it.

Conclusion

As we’ve explored throughout this comprehensive guide, Uniswap stands as a beacon in the DeFi space, offering innovative solutions and a user-centric approach to decentralized finance. From its unique trading mechanisms to its robust governance model, Uniswap is not just a platform for trading but a thriving ecosystem supporting the future of finance.

Key Takeaways

- Innovative Platform: Uniswap’s Automated Market Maker system revolutionizes how we trade cryptocurrencies, making it accessible, efficient, and secure.

- Community-Driven: With its decentralized governance model, Uniswap empowers its users, giving them a voice in the platform’s future.

- Expanding Ecosystem: Continuous developments, from scaling solutions to enhanced security measures, ensure that Uniswap remains at the forefront of the DeFi movement.

- Education and Support: The wealth of resources and an active community provide unparalleled support, making DeFi more accessible to everyone.

Looking Ahead

The journey of Uniswap is far from over. As the DeFi landscape evolves, so too will Uniswap, adapting to new challenges and seizing opportunities to innovate. For traders, investors, and crypto enthusiasts, Uniswap represents not just a platform but a gateway to the possibilities of decentralized finance.

In conclusion, whether you’re a seasoned DeFi veteran or a newcomer to the world of cryptocurrency, Uniswap offers a comprehensive, secure, and user-friendly platform that stands out in the rapidly growing DeFi space. Its impact on the market, commitment to its users, and continuous evolution make it an essential player in the world of decentralized finance.

Uniswap is more than just a DeFi platform; it’s a testament to the power of decentralization and community-driven innovation.