Introduction to Flash Loans

Flash loans have swiftly emerged as a cornerstone of innovation in the Decentralized Finance (DeFi) landscape, offering a unique mechanism for individuals to access significant funds without traditional collateral requirements. This blog post delves into the multifaceted world of flash loans, exploring their mechanics, underlying technology, diverse applications, and the various advantages they bring to the DeFi ecosystem.

We’ll also navigate through the potential risks, legal frameworks, and regulatory considerations that come with utilizing flash loans, alongside practical advice for those looking to get started. From success stories to future prospects, this comprehensive guide aims to equip readers with a thorough understanding of flash loans, illustrating their role in pushing the boundaries of decentralized finance and highlighting their potential to transform traditional financial paradigms. Whether you’re a DeFi veteran or a curious newcomer, join us on this exploration of flash loans, a testament to the innovative spirit of blockchain technology and its capacity to redefine finance.

Table of Contents

How Flash Loans Work

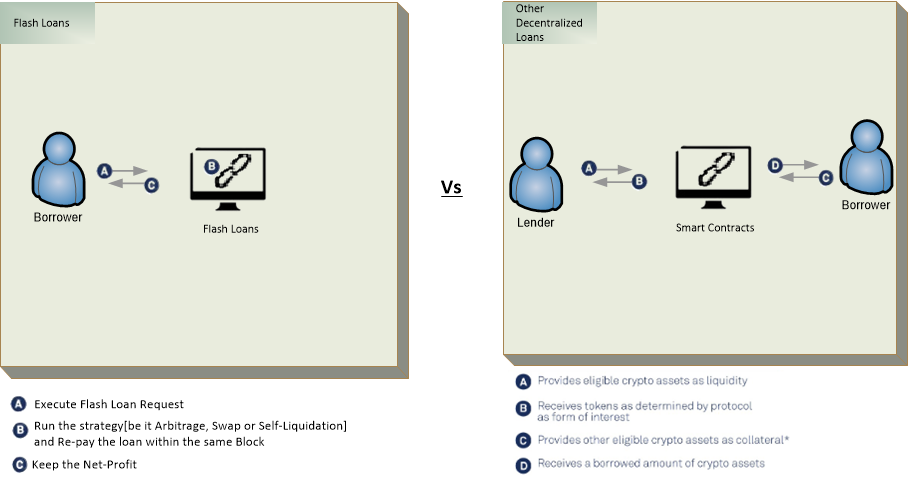

Flash loans represent one of the most intriguing financial innovations birthed by the decentralized finance (DeFi) movement. These are essentially none collateralised loans that, contrary to traditional finance, don’t require the borrower to provide collateral. Instead, the borrowed amount must be returned within the same transaction block. If this condition is not met, the entire transaction is reversed, ensuring no funds are actually loaned out. This mechanism makes flash loans a powerful tool for users who can leverage large sums of capital without upfront collateral, provided they can use it within moments and return it within the blockchain’s transaction time frame.

The Mechanism Behind Flash Loans

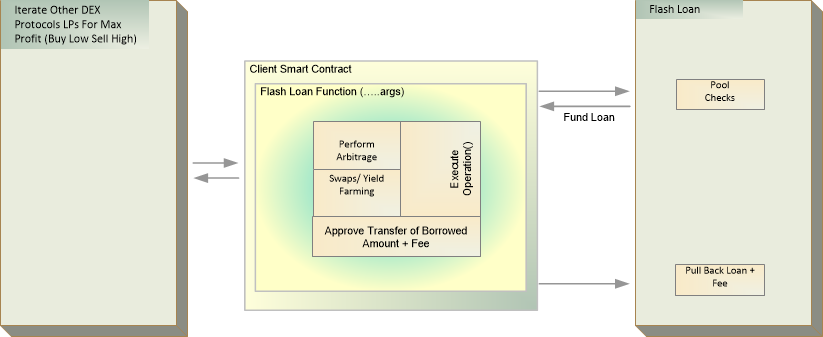

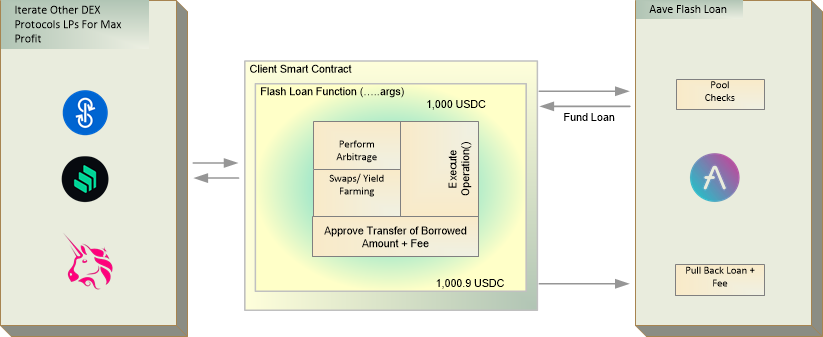

The process begins when a borrower identifies an opportunity to profit from discrepancies in market prices across different DeFi platforms or wishes to execute other complex financial maneuvers such as arbitrage, collateral swapping, or debt refinancing. The borrower then executes a smart contract that borrows funds from a flash loan provider. The smart contract must perform its intended operations (e.g., buying and selling assets for profit) and pay back the loan, plus any associated fees, all within the same transaction.

If the smart contract fails to return the funds, the entire operation is automatically nullified by the blockchain network, as if it never happened. This ensures the safety of the funds in the lending pool, making flash loans a no-loss proposition for the lenders.

Understanding how flash loans work is essential for anyone interested in the DeFi space. Their unique nature offers unprecedented flexibility and efficiency in financial operations, allowing for innovative strategies that were previously impossible. By utilizing smart contracts and operating within the rigid framework of blockchain transactions, flash loans open up a world of opportunities for savvy users. However, the complexity and risks involved also mean that a thorough understanding and careful planning are crucial before engaging with this powerful DeFi tool.

The Technology Behind Flash Loans

Flash loans leverage the advanced capabilities of blockchain technology and smart contracts to offer a unique financial product within the decentralized finance (DeFi) ecosystem. This innovative approach to lending and borrowing eschews the traditional banking model’s reliance on credit scores and collateral, enabling instantaneous transactions that are executed only if certain conditions are met. Understanding the technology behind flash loans is key to appreciating their potential impact on the financial world.

Blockchain and Smart Contracts

At the core of flash loans is blockchain technology, a decentralized ledger that records transactions across multiple computers. This ensures that the transactions are secure, transparent, and immutable. Smart contracts, which are self-executing contracts with the terms of the agreement directly written into code, are deployed on the blockchain. They automatically enforce and execute the terms of flash loans.

When a user initiates a flash loan, they are essentially creating a smart contract that interacts with the lending platform’s smart contract. This interaction is programmed to borrow funds, execute the intended operations (like arbitrage), and repay the loan within a single transaction block. If any part of this process fails, the smart contract reverses the transaction, as if it never occurred.

Platforms that Offer Flash Loans

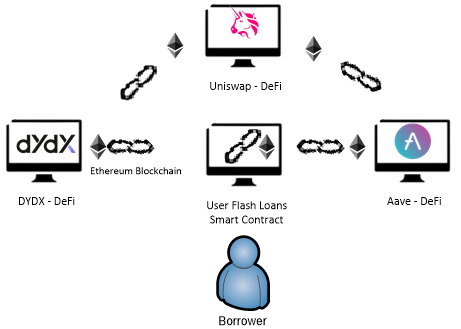

Several DeFi platforms have emerged as leaders in providing flash loan services, utilizing Ethereum’s blockchain, among others, to facilitate these transactions. Aave, dYdX, and Uniswap are notable examples, each offering distinct features and terms for flash loans. These platforms use their own smart contracts to manage the lending pools from which flash loans are drawn.

The technology behind flash loans—blockchain and smart contracts—represents a significant shift from traditional financial mechanisms. By enabling transactions that are secure, transparent, and immediate, flash loans open up new possibilities for arbitrage, liquidity provision, and financial management in the DeFi space. As this technology continues to evolve, so too will the opportunities and applications for flash loans within the broader ecosystem of digital finance.

Use Cases of Flash Loans

Flash loans, a revolutionary financial product of the decentralized finance (DeFi) ecosystem, enable users to borrow substantial amounts of cryptocurrency without collateral. The catch? The loan must be repaid within the same transaction block. This unique feature has opened up a myriad of use cases that were previously inconceivable in traditional finance. Here, we explore some of the most compelling applications of flash loans.

Arbitrage Opportunities

Arbitrage is the practice of profiting from price differences of the same asset on different markets. Flash loans shine in this arena, allowing users to borrow funds to buy a cryptocurrency on one exchange where the price is lower and sell it on another where the price is higher. The profit, after repaying the loan and fees, is kept by the borrower. This all happens in moments, leveraging the speed of blockchain transactions.

Collateral Swapping

DeFi users often need to switch the collateral they’ve locked up in a lending platform to another type of asset without closing their position. Flash loans can facilitate this by lending the user the necessary funds to pay off their original loan, freeing the collateral, which is then immediately swapped for another asset and re-deposited as collateral for a new loan. This swap can optimize the borrower’s interest rates or exposure to asset volatility.

Debt Refinancing

Similar to refinancing a mortgage for a better interest rate, flash loans can be used to settle existing debts in DeFi platforms and take out new loans at more favorable terms. This process can save users significant amounts in interest payments, improve their loan-to-value ratios, or adjust their exposure to certain assets.

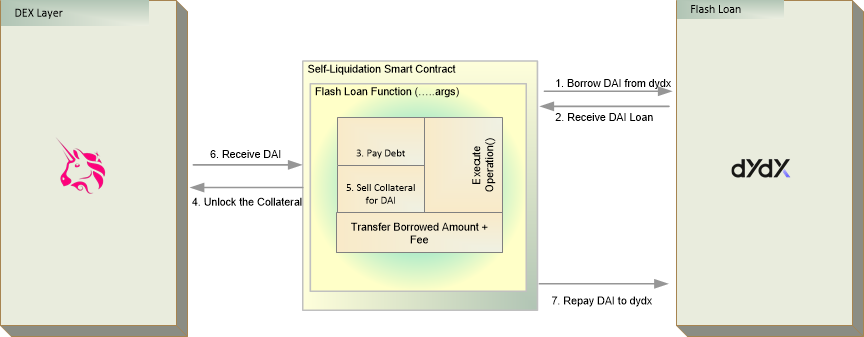

Self-liquidation

In situations where a borrower’s collateral is at risk of liquidation due to adverse market movements, flash loans can be used to preemptively liquidate the collateral. The user can take out a flash loan to repay part or all of their debt, sell some of their collateral at market price rather than a liquidation penalty, and then repay the flash loan. This strategic move can minimize losses and preserve more value than a forced liquidation by the lending platform.

The use cases of flash loans demonstrate their versatility and power within the DeFi ecosystem. By enabling transactions that leverage arbitrage, collateral swapping, debt refinancing, and self-liquidation, flash loans offer sophisticated financial strategies that were previously unavailable to individual investors. As the DeFi space continues to evolve, it’s likely that even more innovative uses for flash loans will emerge, further transforming the landscape of decentralized finance.

Advantages of Flash Loans

Flash loans have emerged as a groundbreaking tool within the decentralized finance (DeFi) ecosystem, offering unique benefits that challenge traditional financial mechanisms. These loans provide liquidity to users without the need for collateral, under the condition that the loan is returned within the same transaction block. Here, we explore the key advantages of flash loans and how they are revolutionizing the way we think about lending and borrowing.

No Collateral Requirement

Unlike traditional loans, which require borrowers to put up collateral, flash loans do not. This opens up opportunities for individuals and entities that might not have sufficient collateral but possess the know-how to utilize these loans profitably. This characteristic democratizes access to significant capital, fostering inclusivity within the financial ecosystem.

Speed and Efficiency

Flash loans are executed almost instantaneously, allowing users to take advantage of time-sensitive opportunities, such as arbitrage across different exchanges. This speed and efficiency are unparalleled in traditional finance, where loan approvals and fund disbursements can take days or even weeks.

Opportunities for Profit

By providing access to substantial liquidity without upfront investment, flash loans enable users to engage in profit-making activities like arbitrage, liquidations, and swapping collateral, which were previously accessible only to well-capitalized individuals or institutions. This levels the playing field, allowing more participants to exploit market inefficiencies.

Flexibility

Flash loans offer unparalleled flexibility, allowing borrowers to execute complex financial operations within a single transaction. This includes multi-step strategies that involve interacting with various DeFi protocols to achieve a specific financial goal, all without the need for starting capital.

Innovation in Financial Products

The advent of flash loans has spurred innovation in financial products and services within the DeFi space. Developers and financial engineers are continually finding new ways to leverage this technology, leading to the creation of more sophisticated and versatile financial instruments.

Flash loans offer a distinct set of advantages that challenge traditional financial paradigms, including accessibility without collateral, instantaneous transactions, and the opportunity to execute complex and profitable financial strategies. These benefits not only enhance the liquidity and efficiency of the DeFi ecosystem but also encourage ongoing innovation and democratization within the financial sector. As the technology and applications of flash loans continue to evolve, they will likely play an increasingly significant role in shaping the future of finance.

Risks and Drawbacks

While flash loans offer numerous advantages and have become a popular tool within the decentralized finance (DeFi) ecosystem, they are not without their risks and drawbacks. Understanding these potential pitfalls is crucial for anyone considering utilizing flash loans, whether for arbitrage, liquidity provision, or other financial strategies. Below, we explore the key risks and drawbacks associated with flash loans.

Market Volatility and Liquidation Risks

Flash loans are highly dependent on the volatile cryptocurrency market. Significant price fluctuations can occur within the short time frame of a flash loan transaction, potentially impacting the profitability of arbitrage or other strategies. Moreover, if a user employs a flash loan for leveraged positions and the market moves against them, they could face substantial losses or liquidation.

Smart Contract Vulnerabilities

The execution of flash loans relies on the flawless operation of smart contracts. However, smart contracts are susceptible to bugs and vulnerabilities, which can be exploited by attackers. Several high-profile incidents have demonstrated that even a small oversight in smart contract design can lead to substantial financial losses.

Ethical Concerns and Potential for Misuse

Flash loans have been utilized in some controversial ways, including to exploit vulnerabilities in DeFi protocols, leading to significant financial losses for those platforms and their users. This has raised ethical questions about the use of flash loans and concerns over their potential to destabilize the DeFi ecosystem.

Complexity and Accessibility

While flash loans democratize access to significant capital, the complexity of designing and executing a successful flash loan strategy requires a deep understanding of DeFi protocols, smart contracts, and the cryptocurrency market. This complexity can be a barrier to entry for less experienced users.

Regulatory Uncertainty

The rapid evolution of DeFi and financial tools like flash loans has outpaced regulatory frameworks. This uncertainty poses a risk to users, as future regulations could affect the legality or functionality of flash loans, impacting those who rely on them for financial strategies.

Flash loans are a powerful tool in the DeFi space, offering unprecedented opportunities for profit and financial strategy execution without the need for collateral. However, the risks and drawbacks, including market volatility, smart contract vulnerabilities, ethical concerns, complexity, and regulatory uncertainty, must be carefully considered. As the DeFi ecosystem continues to evolve, understanding and mitigating these risks will be crucial for the safe and responsible use of flash loans.

Flash Loans and DeFi (Decentralized Finance)

Flash loans have become a defining feature of the Decentralized Finance (DeFi) landscape, showcasing the innovative and dynamic nature of blockchain-based financial services. These unique lending mechanisms allow individuals to borrow without collateral, provided the loan is repaid within the same transaction block. This integration of flash loans into DeFi platforms has not only expanded the capabilities of these platforms but also highlighted the potential for blockchain technology to revolutionize traditional finance.

The Role of Flash Loans in DeFi

Flash loans serve multiple functions within the DeFi ecosystem, from enabling arbitrage and market efficiency to facilitating complex financial operations like collateral swaps and liquidations. They exemplify the principle of permissionless finance, where anyone with a wallet and an idea can access substantial capital to execute their strategies. This has led to increased liquidity and dynamism within the DeFi market, making it more competitive and efficient.

Impact on Liquidity and Market Dynamics

By allowing instant access to capital, flash loans have significantly impacted market liquidity. Traders and arbitrageurs use these loans to capitalize on price discrepancies across different platforms, helping to ensure that asset prices remain consistent and fair. This contributes to a more stable and efficient market, benefiting all participants in the ecosystem.

Challenges and Opportunities

The integration of flash loans into DeFi has also presented challenges, particularly concerning security and the potential for exploitation. High-profile attacks exploiting vulnerabilities in smart contracts have led to significant losses. However, these challenges also drive innovation, with continuous improvements in smart contract auditing and security protocols enhancing the overall robustness of the DeFi ecosystem.

Flash loans are a hallmark of innovation within the DeFi sector, embodying the transformative potential of decentralized finance. By providing a mechanism for uncollateralized, instant loans, they open up new avenues for financial strategies that were previously unimaginable. Despite the challenges and risks associated with their use, flash loans contribute significantly to the liquidity, efficiency, and dynamism of the DeFi market. As the DeFi ecosystem continues to mature, flash loans will likely remain at the forefront of its evolution, continually pushing the boundaries of what is possible in finance.

Comparing Flash Loan Providers

In the rapidly evolving landscape of Decentralized Finance (DeFi), flash loans have emerged as a powerful tool, offering users the ability to borrow funds without collateral, provided they repay within the same transaction block. Several platforms have risen to prominence, offering flash loans with varying terms, fees, and features. Understanding the differences between these providers is crucial for anyone looking to leverage flash loans effectively. Below, we compare some of the leading flash loan providers in the DeFi space: Aave, dYdX, and Uniswap.

Aave

Aave is a decentralized lending and borrowing protocol that has become synonymous with flash loans in the DeFi space. It offers a wide range of assets for flash loans and is known for its innovative features, such as rate switching (from stable to variable rates) and the aTokens (interest-earning tokens) system.

- Fees: Aave charges a 0.09% fee on flash loans, which is relatively low and contributes to its popularity.

- Assets Available: Offers one of the widest ranges of assets for flash loans.

- User Experience: Known for its user-friendly interface and extensive documentation, making it accessible for both beginners and experienced users.

dYdX

dYdX operates as a decentralized exchange focusing on margin trading, spot trading, and derivatives, in addition to offering flash loans. Its unique selling point is the integration of flash loans with trading operations, allowing users to execute complex trades without leaving the platform.

- Fees: dYdX does not charge a direct fee for flash loans, but users must pay for other associated costs, such as trading fees.

- Assets Available: While offering fewer assets than Aave, dYdX focuses on the most liquid and popular cryptocurrencies.

- User Experience: Targets more experienced traders with features geared towards advanced trading strategies.

Uniswap

Uniswap, primarily known as an automated market maker (AMM), also offers flash loans. Its approach is unique because flash loans are integrated with liquidity pool operations, facilitating the use of these loans for arbitrage, liquidity provision, and other DeFi strategies.

- Fees: Uniswap’s flash loan fees are dynamic, depending on the liquidity pool’s fee structure.

- Assets Available: Limited to the assets available in its liquidity pools, which still encompasses a broad range of options.

- User Experience: Highly intuitive, making it suitable for users at all levels of expertise.

Choosing the right flash loan provider depends on various factors, including the specific needs of the user, the assets they wish to borrow, and the fees they’re willing to pay. Aave, dYdX, and Uniswap each offer unique advantages and cater to different segments of the DeFi community. By comparing these platforms, users can make informed decisions that best suit their financial strategies and goals. As the DeFi ecosystem continues to expand, we can expect to see even more innovation and diversification in the services offered by flash loan providers.

Success Stories and Notable Uses

Flash loans, a standout innovation in the Decentralized Finance (DeFi) landscape, have empowered users with unprecedented financial strategies. These loans, which must be borrowed and repaid within a single transaction, have facilitated remarkable success stories across various applications, from arbitrage to liquidity provision. Here, we delve into some of the most compelling success stories and notable uses of flash loans, showcasing their transformative impact on DeFi strategies.

Major Arbitrage Wins

Arbitrage strategies stand out as one of the most lucrative applications of flash loans. A significant success story involves an individual who leveraged a flash loan to capitalize on price discrepancies between two DeFi platforms. By borrowing a substantial amount through a flash loan, the user bought a token at a lower price on one exchange and sold it at a higher price on another, repaying the loan and pocketing the profits in a matter of seconds. This operation not only demonstrated the efficiency of flash loans but also highlighted their potential for risk-free profit in a highly volatile market.

Innovative Debt Refinancing

Flash loans have also played a pivotal role in debt refinancing within the DeFi ecosystem. In a notable instance, a user employed a flash loan to pay off an existing high-interest debt and immediately took out a new loan at a lower interest rate. This strategic move allowed the user to significantly reduce their interest payments, showcasing the power of flash loans in optimizing financial obligations with agility and precision.

Strategic Collateral Swaps

Another area where flash loans have shown remarkable utility is in facilitating collateral swaps. A user successfully executed a collateral swap to avoid liquidation, using a flash loan to temporarily repay their debt, swap their collateral for a more stable asset, and then take out a new loan against this asset, all within a single transaction. This strategy effectively demonstrates how flash loans can provide flexibility and safety nets against market volatility.

Liquidation Prevention and Profit

A particularly inventive use of flash loans involved preventing the liquidation of undercollateralized positions in lending protocols. Users have leveraged flash loans to add liquidity to their positions, reducing their loan-to-value ratio and avoiding costly liquidations. Additionally, savvy users have utilized flash loans to execute liquidations on undercollateralized positions, profiting from the liquidation bonuses offered by many DeFi platforms.

The success stories and notable uses of flash loans underscore their revolutionary role in DeFi, enabling strategies that were previously inconceivable. From facilitating instant arbitrage opportunities to enabling strategic financial maneuvers like debt refinancing and collateral swaps, flash loans have proven to be a powerful tool in the DeFi toolkit. As the ecosystem continues to evolve, we can expect to see even more innovative applications of flash loans, further pushing the boundaries of decentralized finance.

The Future of Flash Loans

Flash loans have rapidly emerged as a pivotal innovation within the Decentralized Finance (DeFi) sector, offering a glimpse into the future of finance. By enabling users to borrow substantial amounts of cryptocurrency without collateral—provided they repay within the same transaction—flash loans have opened up new avenues for financial strategies. As we look forward, the potential for flash loans to further evolve and impact the DeFi landscape is significant. This section explores the anticipated developments in the realm of flash loans and how they might shape the future of decentralized finance.

Expansion of Use Cases

As the DeFi ecosystem continues to mature, we can expect the use cases for flash loans to expand beyond arbitrage, collateral swaps, and liquidation prevention. Innovative applications in areas such as automated market making, portfolio rebalancing, and insurance could emerge, leveraging the unique capabilities of flash loans to execute complex financial transactions instantaneously.

Enhanced Security Measures

The future of flash loans will undoubtedly involve heightened security measures. Given their past association with exploits and attacks on DeFi protocols, developers are likely to focus on creating more robust smart contract auditing processes and security frameworks. This would not only mitigate the risks associated with flash loans but also bolster confidence in their use among participants in the DeFi space.

Integration with Traditional Finance

Flash loans might find applications beyond the DeFi ecosystem, potentially integrating with traditional financial systems. As blockchain technology continues to gain acceptance, the concept of instant, collateral-free loans could appeal to traditional financial institutions, fostering a convergence between decentralized and conventional finance. This integration could revolutionize liquidity management, trading, and risk assessment in the broader financial market.

Regulatory Developments

The growing prominence of flash loans will likely attract regulatory attention. As authorities seek to understand and oversee DeFi activities, flash loans could become subject to regulatory frameworks. These developments could influence the operation and accessibility of flash loans, emphasizing the importance of compliance and transparency in their use.

Advancements in Technology

Technological advancements will play a crucial role in the future of flash loans. Innovations in blockchain scalability, transaction speed, and smart contract functionality could enhance the efficiency and reliability of flash loans. This would enable more complex and higher-value transactions, further extending the utility and appeal of flash loans within and beyond DeFi.

The future of flash loans looks bright, with potential for significant expansion, innovation, and integration into both decentralized and traditional financial systems. As the DeFi sector continues to evolve, flash loans are poised to play a central role in shaping the landscape of finance, offering more efficient, flexible, and accessible financial services. However, achieving this future will require overcoming challenges related to security, regulation, and technology, ensuring that flash loans can fulfill their promise as a transformation financial tool.

Security Measures and Best Practices

Flash loans, a novel financial instrument within the Decentralized Finance (DeFi) ecosystem, offer significant opportunities but also come with their set of security considerations. Given their ability to mobilize large amounts of capital instantly, without collateral, ensuring the security of these transactions is paramount. This section outlines essential security measures and best practices to mitigate risks associated with flash loans, ensuring their safe and effective use.

Smart Contract Auditing

Before engaging with flash loans, it’s crucial to ensure that the smart contracts involved are thoroughly audited. Smart contract vulnerabilities can lead to significant financial losses, as seen in various exploits within the DeFi space. Comprehensive auditing by reputable firms or community-driven audits can help identify and rectify potential security flaws.

Utilizing Trusted Platforms

Opt for flash loan services provided by established and reputable DeFi platforms. These platforms are more likely to have undergone rigorous security testing and to have a track record of handling security incidents. Researching platform history and community feedback can provide insights into their reliability and security standards.

Understanding the Mechanisms

A deep understanding of how flash loans and the associated DeFi protocols work is essential for identifying risks and preventing losses. Users should familiarize themselves with the transaction flow, potential failure points, and the specific conditions under which loans must be repaid.

Risk Management

Implementing risk management strategies is crucial when using flash loans. Given their unique requirement for repayment within the same transaction block, users must plan for scenarios where transactions might fail, potentially due to unexpected shifts in market conditions or gas prices. Setting up fallback mechanisms or limits on transactions can help manage these risks.

Keeping Abreast of DeFi Developments

The DeFi ecosystem is rapidly evolving, with new protocols and mechanisms emerging regularly. Staying informed about the latest developments, security practices, and potential vulnerabilities in the space can help users navigate flash loans more safely.

While flash loans offer unparalleled opportunities within the DeFi space, their safe use depends on rigorous security measures and adherence to best practices. By conducting thorough smart contract audits, choosing reputable platforms, understanding the underlying mechanisms, implementing risk management strategies, and staying updated on DeFi developments, users can significantly mitigate the risks associated with flash loans. As the DeFi ecosystem continues to evolve, prioritizing security will ensure that flash loans remain a valuable and safe tool for financial innovation.

Legal and Regulatory Considerations

As flash loans continue to gain popularity within the Decentralized Finance (DeFi) ecosystem, understanding the legal and regulatory considerations is paramount for users and providers alike. These innovative financial instruments allow for significant, collateral-free loans to be issued and repaid within a single transaction, challenging traditional financial regulations and legal frameworks. This section outlines the key legal and regulatory considerations surrounding flash loans, aiming to provide clarity for those navigating this evolving landscape.

Navigating the Regulatory Landscape

The decentralized nature of flash loans and the broader DeFi sector presents unique challenges to regulatory oversight. Currently, the regulatory framework for DeFi and flash loans is underdeveloped, with jurisdictions around the world still determining how to apply existing financial laws to these new technologies. It is crucial for users and providers of flash loans to stay informed about regulatory changes and understand how they might impact the availability and functionality of flash loans.

Compliance and Anti-Money Laundering (AML)

One of the primary legal considerations for flash loan providers is compliance with Anti-Money Laundering (AML) regulations. Given the anonymous or pseudonymous nature of blockchain transactions, ensuring that flash loans are not used to facilitate illegal activities is a significant concern. Providers may need to implement measures to track transactions and identify users, potentially impacting the decentralized ethos of DeFi.

Consumer Protection

Consumer protection is another important legal consideration. The complexity and potential risks associated with flash loans raise concerns about protecting users from fraud, scams, and unintended losses. Regulatory bodies may introduce guidelines or requirements aimed at ensuring transparency and fairness in the use of flash loans, which could include mandatory disclosures of risks and terms.

Cross-Border Legal Challenges

The global accessibility of DeFi platforms and flash loans introduces cross-border legal challenges. Different countries may have varying regulations regarding cryptocurrencies and financial services, complicating compliance for flash loan providers operating internationally. Understanding the legal implications in each jurisdiction and navigating the complexities of international law will be crucial for the continued growth of flash loans.

Legal and regulatory considerations play a critical role in shaping the future of flash loans and the broader DeFi sector. As regulators around the world grapple with the implications of these innovative financial tools, staying informed and proactive in compliance efforts will be key for both providers and users. The dynamic regulatory landscape requires ongoing attention and adaptation to ensure that flash loans continue to offer a secure, transparent, and legally compliant means of accessing financial services.

How to Get Started with Flash Loans

Flash loans have revolutionized the Decentralized Finance (DeFi) space by offering instant, collateral-free loans to users, provided they can repay the amount within the same transaction block. For those new to DeFi or flash loans, beginning can seem daunting due to the complex nature of these transactions. However, by breaking down the process into manageable steps, anyone can start exploring the potential of flash loans. Here’s a beginner-friendly guide on how to get started with flash loans.

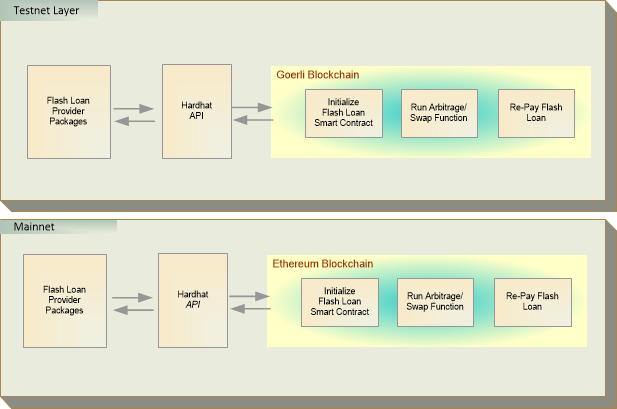

Understand the Basics of DeFi and Smart Contracts

Before diving into flash loans, it’s crucial to have a solid understanding of the DeFi ecosystem and how smart contracts work. Flash loans are executed through smart contracts on blockchain platforms, primarily Ethereum. Familiarize yourself with blockchain technology, smart contracts, and the principles of DeFi to build a strong foundation.

Choose a Flash Loan Provider

Several DeFi platforms offer flash loans, each with its unique features, supported cryptocurrencies, and fee structures. Popular providers include Aave, dYdX, and Uniswap. Research these platforms to understand their requirements, fees, and the assets they support for flash loans.

Learn Solidity or Other Smart Contract Languages

To execute a flash loan, you’ll need to interact with a DeFi protocol’s smart contract. This typically involves writing your own smart contract in Solidity (the programming language used for Ethereum smart contracts) or another relevant language. Start with basic tutorials on Solidity to get comfortable with writing and deploying smart contracts

Experiment on Testnets

Before executing a flash loan on the mainnet (the primary blockchain network where transactions have real economic value), practice on a testnet. Testnets allow you to simulate flash loan transactions without risking real money, providing a valuable learning experience. Ethereum’s Ropsten and Kovan are examples of testnets where you can test your flash loan strategies.

Develop a Strategy

Successful use of flash loans requires a clear strategy. Whether it’s for arbitrage, collateral swapping, or another financial maneuver, outline your plan in detail. Consider the assets you’ll interact with, the platforms you’ll use, and how you’ll profit from the transaction. Ensure your strategy also accounts for transaction fees, which can affect the profitability of your operation.

Stay Informed and Continue Learning

The DeFi space is rapidly evolving, with new platforms, tools, and strategies emerging regularly. Stay informed about the latest developments in flash loans and DeFi by following industry news, participating in community forums, and continuously exploring new learning resources.

Getting started with flash loans involves a steep learning curve, but the potential rewards and insights into advanced DeFi operations are substantial. By understanding the basics, choosing the right platform, learning to code smart contracts, practicing on testnets, and developing a sound strategy, you can begin to explore the exciting possibilities flash loans offer. Remember, the key to success in DeFi is continuous learning and adaptation.

Frequently Asked Questions (FAQ)

Flash loans are a novel concept in the Decentralized Finance (DeFi) space, offering unique opportunities for users to leverage large sums of capital without collateral, albeit with the condition of repaying within the same transaction block. Given their complexity and innovative nature, flash loans raise many questions. Below, we address some of the most frequently asked questions to clarify how flash loans work and their implications for users.

What Are Flash Loans?

Flash loans are uncollateralized loans that allow borrowers to access significant amounts of capital without the need for upfront collateral, under the condition that the loan is repaid within the same blockchain transaction. Originating in the DeFi ecosystem, flash loans are utilized for various financial strategies, including arbitrage, collateral swaps, and liquidation prevention.

How Do Flash Loans Work?

Flash loans work by utilizing smart contracts on blockchain platforms. A borrower initiates a flash loan through a smart contract, which then executes predefined actions—such as trading or swapping assets—and repays the loan within the same transaction. If the loan is not repaid, or if any condition of the contract is not met, the entire transaction is reversed, as if it never happened.

Are Flash Loans Risky?

Flash loans themselves carry no risk of default for the lender since the loan must be repaid within the same transaction. However, they do carry risks for the borrower, including potential for smart contract vulnerabilities, market volatility affecting the profitability of transactions, and high transaction fees that could erode profits. Additionally, improper use can lead to financial losses, especially if the transaction fails to execute as planned.

Can Anyone Use Flash Loans?

Technically, anyone with knowledge of smart contracts and the DeFi ecosystem can initiate a flash loan. However, effectively utilizing flash loans requires a deep understanding of blockchain technology, smart contract programming (typically in Solidity for Ethereum-based transactions), and specific financial strategies to ensure profitability.

What Can Flash Loans Be Used For?

Flash loans are primarily used for:

- Arbitrage opportunities between different exchanges or DeFi platforms.

- Swapping collateral in lending protocols without closing the original loan.

- Paying off debts to avoid liquidation or to secure better loan terms.

- Profitable liquidations within DeFi platforms by repaying loans of undercollateralized positions.

How Much Does It Cost to Take a Flash Loan?

The cost of taking a flash loan varies between providers but generally includes a fee based on the amount borrowed. This fee can range from 0.03% to 0.3% of the loan amount. Additionally, borrowers must account for gas fees (transaction fees on the blockchain), which can fluctuate based on network congestion.

Are Flash Loans Legal?

Flash loans operate in a legal gray area, as the regulatory framework for DeFi and cryptocurrency is still evolving. Users should stay informed about local regulations and any changes that might affect the legality of using flash loans in their jurisdiction.

How Can I Start Using Flash Loans?

To start using flash loans, one should:

- Gain a solid understanding of DeFi and smart contracts.

- Learn to program in Solidity or another smart contract language.

- Choose a flash loan provider and familiarize yourself with their platform and fees.

- Develop a strategy and test it on a blockchain testnet.

- Continuously monitor for changes in regulations and flash loan protocols.

Flash loans offer a powerful tool within the DeFi ecosystem for those who understand how to leverage them effectively. While they open up numerous financial strategies without the need for traditional collateral, they also require a high level of technical and market knowledge to use successfully. As the DeFi space continues to evolve, so too will the opportunities and complexities associated with flash loans.

Conclusion

Flash loans represent a groundbreaking innovation in the Decentralized Finance (DeFi) ecosystem, offering a unique blend of opportunities and challenges that underscore the potential of blockchain technology to redefine traditional financial paradigms. As we’ve explored throughout this blog post, from the mechanics of how flash loans work, the technology behind them, their varied use cases, to the legal and regulatory landscape that governs them, it’s clear that flash loans are much more than a fleeting trend in the crypto space.

The ability to borrow substantial amounts of capital without collateral, albeit with the caveat of repaying within the same transaction block, has opened up new avenues for arbitrage, leverage, and financial strategies that were previously inaccessible to the average investor. The success stories and notable uses of flash loans we’ve discussed illustrate not only the potential for profit but also the creative ways in which these tools can be employed to manage risk, optimize portfolios, and navigate the complex web of DeFi protocols.

However, as with any innovative financial instrument, flash loans come with their share of risks and drawbacks, particularly related to market volatility, smart contract vulnerabilities, and the evolving regulatory environment. These factors necessitate a cautious and informed approach to utilizing flash loans, emphasizing the importance of understanding the underlying technology, staying abreast of legal developments, and adhering to best practices in security and risk management.

Looking ahead, the future of flash loans appears promising, with the potential for broader adoption, the development of new use cases, and further technological advancements that enhance their efficiency, security, and accessibility. As the DeFi ecosystem continues to mature, flash loans are poised to play a pivotal role in shaping the landscape of decentralized finance, offering a glimpse into a future where financial services are more inclusive, transparent, and aligned with the principles of an open and decentralized internet.

In conclusion, whether you’re a seasoned DeFi enthusiast or a newcomer curious about the possibilities of flash loans, there’s no denying the impact and potential of these innovative financial tools. By continuing to educate ourselves, engage with the community, and approach these opportunities with a balanced perspective on the risks and rewards, we can all contribute to the responsible growth and development of the DeFi ecosystem. Flash loans are not just a testament to the ingenuity inherent in blockchain technology; they are a beacon for the future of finance, signaling a shift towards more dynamic, accessible, and equitable financial systems.